These days, you can do everything from your phone: shopping, socializing, browsing. So, why not add another use to up the convenience? Why not start Mobile Batai Banking? Mobile banking has ushered in a new era, redefining the way we manage our finances. Gone are the days of enduring long queues at the bank; with mobile banking, financial control is now at your fingertips, anytime, anywhere.

In this article, we will navigate you through a step-by-step guide on mobile banking sign-up, ensuring you are able to harness the benefits and features of mobile banking. Whether you are a newbie in the mobile banking realm or seeking to refresh your knowledge, we’ll take you through the process to make your user experience seamless.

Step 1: Selecting Your Mobile Banking Ally

Firstly, you will need a trusted service provider. You will need to have an account with a bank, then sign up for their mobile banking service. In Nepal, we have plenty of trustworthy banks and finances and with the increase in digital adoption most of these organizations offer their mobile banking app. All you need to do is download the app and commence registration. Make sure the app is the legitimate one and stay vigilant of fraudulent apps.

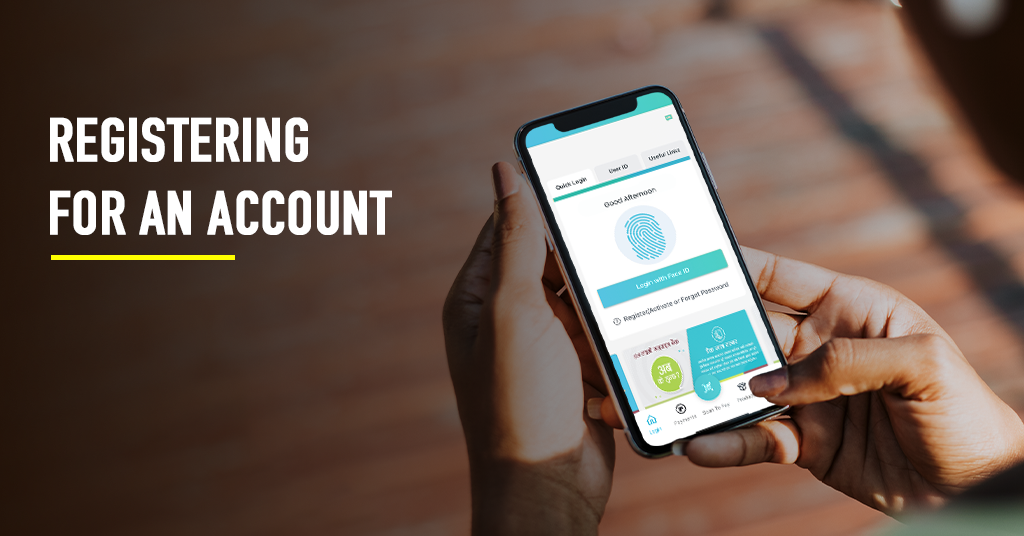

Step 2: Registering for an Account

With the app downloaded, proceed to register for an account. Enter accurate personal details during the registration process, as they will be crucial for security and identity verification. Create strong login credentials, adhering to the provider's password requirements. Some apps may offer additional authentication methods, such as fingerprint or facial recognition. Enable these features if your device supports them for added security. Review and accept the provider's terms and conditions, and follow any confirmation instructions received via email or message.

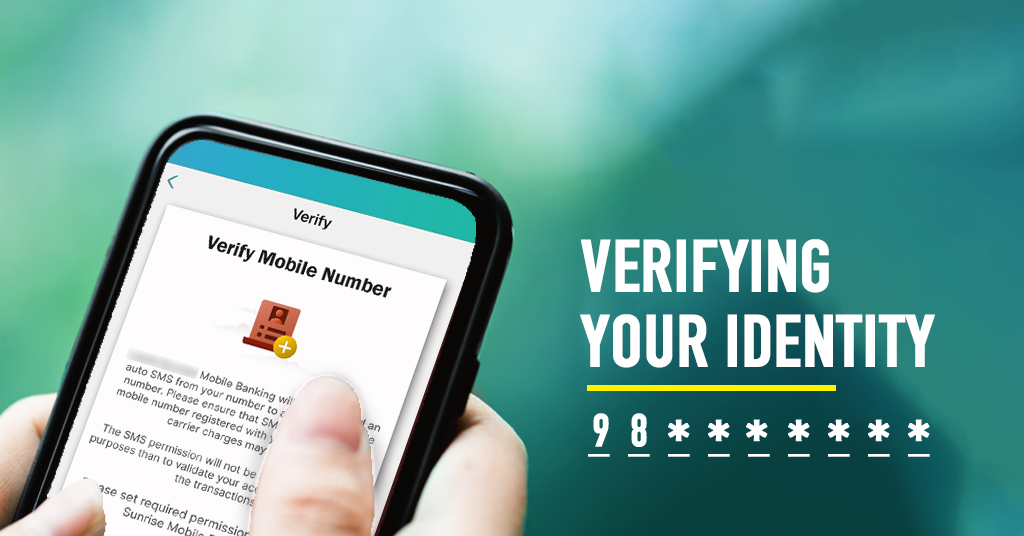

Step 3: Verifying Your Identity

Verification is crucial in mobile banking. By entering your mobile number and account number you will receive the confirmation for verification code. Some providers may also require your Citizenship number or Date of Birth. Ensure accurate and valid information during this step to prevent delays in accessing app features. Promptly respond to any additional requests from the provider. Once verified, you will be notified via text message and you'll gain full access to the app's features.

Step 4: Setting Up Security Measures

With the verification done you will need to set up the security measures. With mobile banking security should take the utmost priority. To make your account secure make sure to adhere to the following:

Strong Password: Create a unique, strong password and regularly update it.

Two-Factor Authentication: Enable Two Factor Authentication for an added layer of security.

Biometric Authentication: Use fingerprint or facial recognition if supported.

Regular App Updates: Keep the app updated for the latest security features.

Beware of Phishing: Avoid suspicious links and only provide information to trusted sources.

Secure Network Connections: Use secure Wi-Fi connections or mobile data to prevent vulnerabilities.

Enable Account Notifications: Stay informed about account activity with timely alerts.

Regular Transaction Reviews: Monitor transactions for any unauthorized activity.

By following these measures, you can significantly reduce the risk of unauthorized access to your account.

Step 5: Exploring Mobile Banking Features

Explore the app's features for efficient financial management. Some of the features offered are:

Account Overview: Get a quick snapshot of balances and transactions.

Funds Transfer: Seamlessly transfer money between banks and financial institutions.

Top-up: Access mobile recharge and data top up easily.

Fonepay Bill Payment: Make payments for various services.

Cardless Withdrawal: Access cardless withdrawals from your nearest ATM.

Account Statements: Access transaction history and statements.

Fully covering and understanding these features enhances the convenience of mobile banking.

Step 6: Start your Mobile Banking Journey!

Now that your mobile banking account is set up, embrace the convenience it offers through regular monitoring, and easy access to banking services on the go. With mobile banking in your hand you will have no worries of forgetting your wallet or not having enough money in hand as your bank will be in your pocket. Let’s start Mobile Batai Banking today!