Mobile banking in Nepal has come a long way, making daily transactions easier and more convenient. Mobile banking has revolutionized how we manage our finances. With smartphones becoming more accessible and internet connectivity improving, mobile banking apps are now packed with features that make life easier. If you're not taking full advantage of mobile banking apps, you might be missing out on features that can save time and effort. Here are the top seven mobile banking features you should start using in 2025.

1. View Statements To Know Your Transaction History

Gone are the days of keeping paper receipts or visiting the bank just to check your transactions. With mobile banking apps, you can instantly view your transaction history, track expenses, and monitor your account balance anytime. This feature helps you stay on top of your finances and detect any suspicious transactions immediately. Whether you’re in Kathmandu or a remote village, your financial diary is just a tap away.

2. Mobile Top-Up for Instant Recharge

Running out of mobile balance at a crucial moment? No worries! With the mobile top-up feature, you can recharge your phone balance instantly without visiting a store. Whether you're using NTC, Ncell, or Smart Cell, just a few taps on your mobile banking app will get you connected again. No more searching for recharge cards or visiting shops—just a few taps on mobile banking, and you’re good to go.

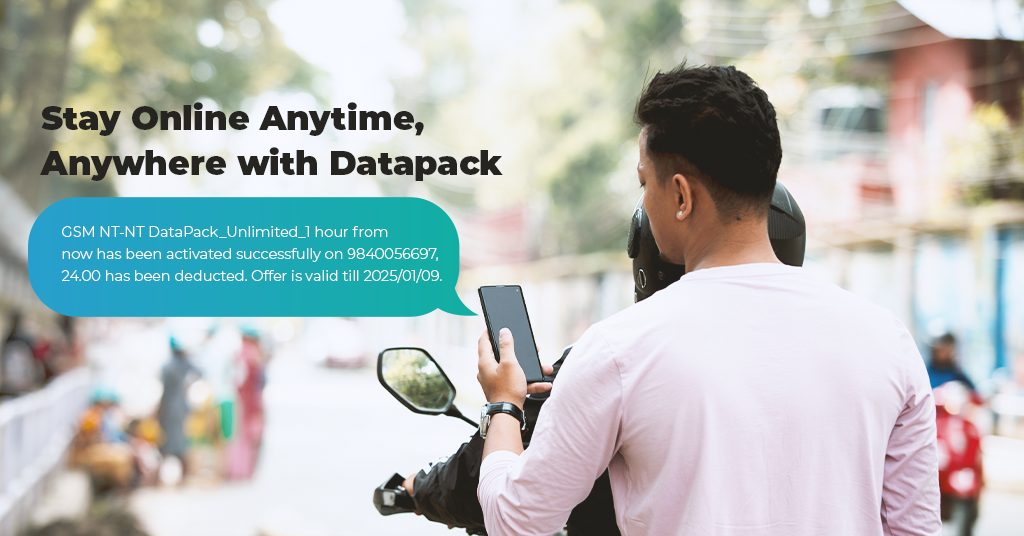

3. Data Pack Purchase: Stay Online Anytime

In today’s digital age, staying online is a necessity. Internet is essential for everything, from communication to entertainment. With mobile banking, you can purchase data packs for your phone without needing to dial codes or visit service providers. Whether you need a daily, weekly, or monthly package, buying data is now faster and easier than ever.

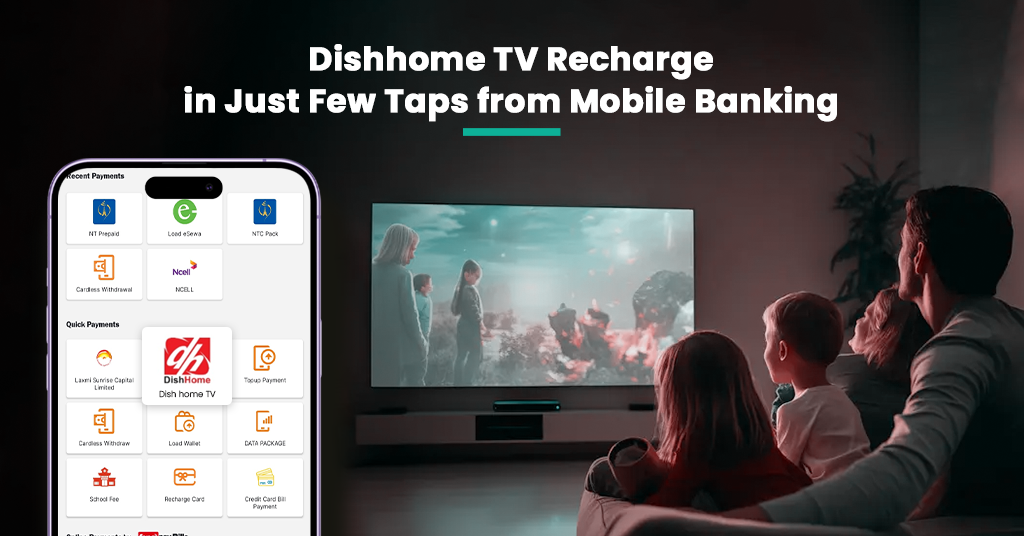

4. Entertainment Made Easy: Dishhome TV Recharge

Why stand in long queues to recharge your Dishhome TV subscription? Mobile banking apps now let you recharge your Dishhome account from the comfort of your home. Whether it’s for your favorite Nepali serials or international channels, this feature ensures uninterrupted entertainment for your family.

5. Grow Your Savings: Online Fixed Deposit Opening

Saving money is crucial, and now you don’t have to visit a bank to open a fixed deposit account. Many banks now allow customers to start a fixed deposit online via their mobile banking app. This feature helps you grow your savings while enjoying higher interest rates—all from the comfort of your home.

6. Scan and Pay: Quick and Secure Payments

Paying bills has never been easier. Carrying cash is becoming a thing of the past, thanks to QR-based payments. With the Scan and Pay feature, you can simply scan a QR code to settle your bills instantly. Whether it’s for groceries, restaurants, or services, this feature saves time and eliminates the need for cash. It’s fast, secure, and perfect for Nepal’s growing digital economy.

7. Utility Payments: Skip the Long Lines

Tired of standing in long queues to pay your electricity, water, or internet bills? Mobile banking apps let you pay utility bills in seconds. Whether you’re at home or on the go, this feature ensures your payments are made on time, every time. Say goodbye to late fees and hello to convenience. This feature not only saves time but also ensures you never miss a due date.

Mobile banking is no longer just a convenience—it’s a necessity. In Nepal, where digital adoption is rapidly growing, these mobile banking features are transforming how we manage our finances. From staying connected to growing your savings, mobile banking apps are making life simpler and more efficient. So, if you haven’t already, it’s time to explore these features and take full advantage of what mobile banking has to offer.