Mobile banking in Nepal is on the rise: it has swiftly overtaken other means of digital payments within just a few years of adoption. Mobile banking had a slow start in Nepal, with very few banks offering the service, and no payment networks to manage transactions between banks. This meant that mobile banking was limited in its scope, and had very few users.

That changed with the advent of Fonepay, which is now the most popular payment system operator in Nepal. Fonepay, which started operations in 2019, was the first payment network in Nepal that connected all the major banks, allowing inter-bank fund transfers and opening many other possibilities. With the addition of Fonepay merchants, QR payments have become one of the most popular methods of payment in Nepal today, available in giant retailers to small kirana stores.

To gain insight into mobile banking users, we initiated several research initiatives with MBA students, namely Asmita Shrestha, Sajiya Shrestha, and Pratikshya Bhandari to gauge the reasons for using mobile banking. The research efforts included over 620 people and asked them various questions about their mobile banking usage (or lack thereof), and what their concerns were regarding the service.

Adoption of Mobile Banking in Nepal

One of the biggest drivers for the adoption of mobile banking in Nepal was the pandemic. Due to the lockdown and the restrictions placed upon the public, mobile banking was one of the most convenient methods of payment and banking available. The pandemic saw a huge rise in the adoption of mobile banking both on the user’s end as well as for businesses. Once people started using mobile banking, there was a surge in retention of the service as well, since people found it extremely convenient.

Fonepay merchants have grown from zero to over 1.2 million merchants in under 3 years. This is incredible growth, and QR payments are essential for any business in the major cities today. All commercial banks, as well as development banks and other financial institutions, have mobile banking as a core banking service now. Mobile banking is no longer an added benefit, it is now considered an essential service.

Why Are People Adopting Mobile Banking?

There are several reasons why mobile banking is being adopted in Nepal, which include:

Influence of the COVID-19 Pandemic

The COVID-19 pandemic acted as a catalyst, propelling the adoption of mobile banking worldwide, Nepal included. Lockdowns and social distancing measures prompted individuals to explore digital alternatives for their financial needs. Mobile banking emerged as a safe haven, allowing users to responsibly manage their finances while adhering to social distancing guidelines

Time-Saving and Accessibility

The catalyst of COVID-19 showed that just with a smartphone and an internet connection, individuals can access their bank accounts anytime, anywhere. There was no need to endure long queues or adhere to rigid banking hours. With mobile banking, users could effortlessly pay bills, transfer funds, and check their account balances without any hassle.

Expanding Range of Services

The continuous expansion of services offered through mobile banking has attracted users from various demographics. Initially limited to basic functionalities like balance inquiries and fund transfers, mobile banking now encompasses a wide range of services. Users can conveniently pay bills, manage investments, apply for loans, open fixed deposit accounts, and do a lot more. These ever-increasing service options have effectively increased mobile banking adoption due to the convenience that it provides.

Efforts from the Banks

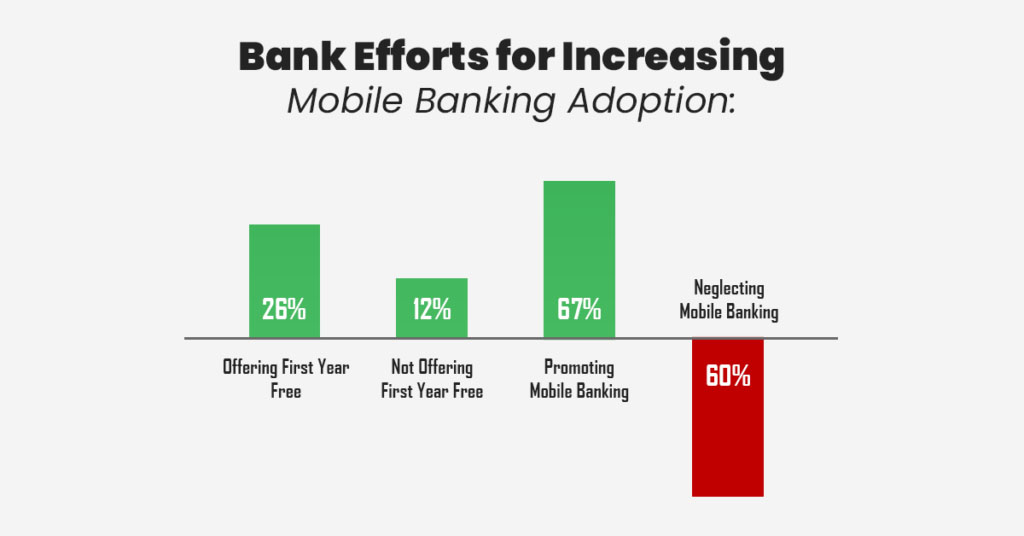

There are several efforts led by the banks themselves that contributed to the increased adoption of mobile banking. These include offering the first year of mobile banking for no cost, which saw an annual increase in new users by 26% in one bank, compared to an increase of just 12% for a bank that did not offer the same.

Active participation in the promotion of digital services saw much more effective results, with one bank that promoted its mobile banking service heavily showing up to 67% annual increase of users, compared to a decrease of 60% of users for another bank that did not focus at all on the topic.

These numbers show that promoting mobile banking capabilities is a highly effective method for increasing users, and neglecting to do so has a highly detrimental effect on the same.

Education Levels Affecting Mobile Banking Adoption

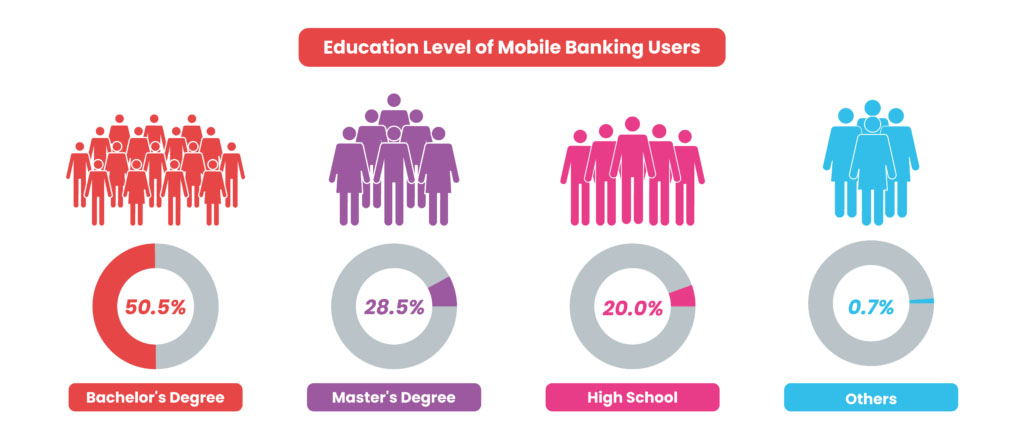

Although mobile banking is considered essential, there is still significant hesitation and pushback for its adoption. One of the main factors that we identified in a study conducted was the lack of education. Most of the users of mobile banking were highly educated (>50% up to bachelor’s level).

One of the main reasons for this divide is that mobile banking services were not available in languages other than English until recently.

Other Reasons for Not Using Mobile Banking

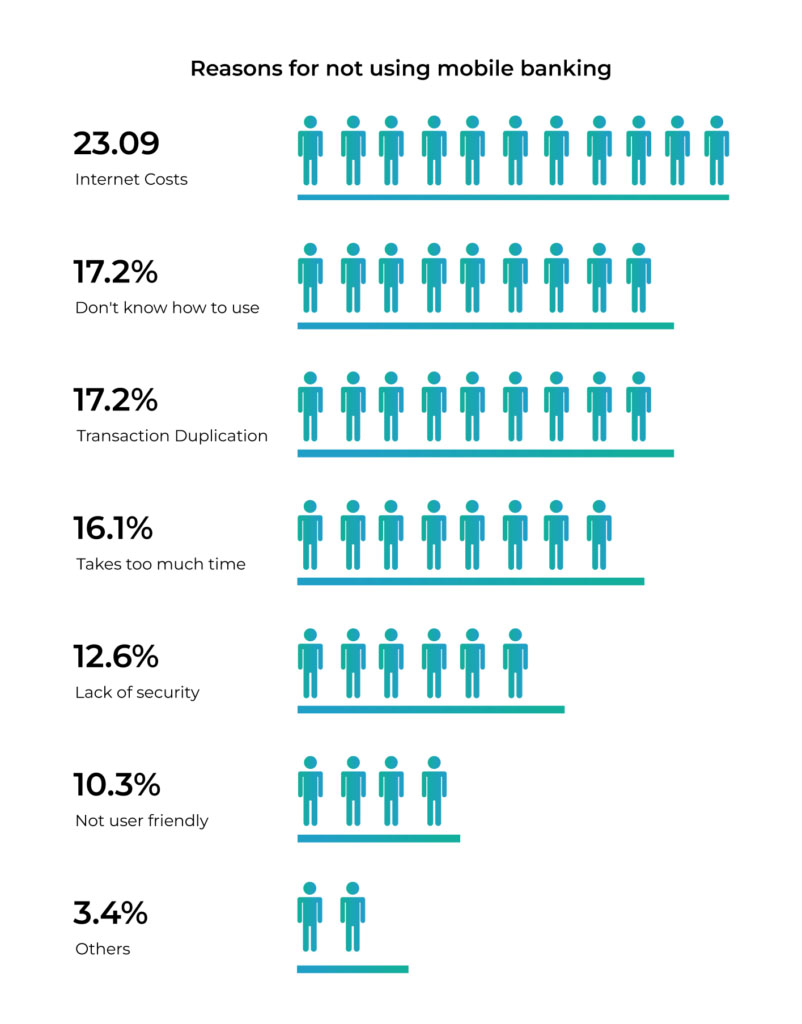

People who do not use mobile banking are doing so due to a number of primary reasons, a few of which were identified during our research. These factors include:

The biggest reason for not using mobile banking is the cost of the internet in the country. While WiFi might be relatively cheap, it is still limited to urban areas, and data cost is quite high in the country. India saw a massive increase in online transactions once their internet became affordable, and the lack of infrastructure seems to be a big hindrance to the proliferation of mobile banking.

The other reasons why mobile banking is not used much is the lack of knowledge on how to use it, and also the phenomenon of transaction duplication, where the app shows that the transaction was not successful but the funds still get debited from the user’s account. This causes the user to perform the transaction again, making them pay double for the same payment.

The perceived lack of security is also a significant reason for the disuse of mobile banking, which is due to the fact that mobile banking users are susceptible to scams, which is a major risk.

Mitigation of Risks Related to Mobile Banking

While mobile banking can be extremely useful, it can also have its risks. The biggest risk of mobile banking is the potential of fraud. The most common of these include lottery scams, OTP phishing, job scams, and fake payment scams. Apart from the final one, the other three affect mobile banking users, whereas the fake payment scam affects merchants. But no matter who it affects, these scams have a detrimental effect on mobile banking users.

There is a popular saying in Nepali: अगुल्टोले हानेको कुकुर बिजुली चम्कँदा तर्सिन्छ, which is equivalent to the English phrase: once bitten, twice shy. People who fall victim to these scams become extremely hesitant on using mobile banking again and also discourage others from doing the same. These scams and risks need to be mitigated, and mitigated effectively for mobile banking to gain popularity across the general populace.

The most effective way to combat this is through education: people need to know what kind of messages to trust and which messages/calls are fraudulent. While it might feel obvious to a lot of people, there is a significant number of people who do fall for these scams. The best way to combat these risks is to educate the users that there are certain details, such as passwords and OTPs, personal details, and other information that should NEVER be shared, since the bank does not ask for such details and any kind of transaction does not require such details.

What Can Be Done to Improve Mobile Banking Adoption?

To further improve mobile banking adoption in Nepal, it is crucial to address the existing challenges and barriers. These include:

Increase Accessibility and Affordability of Internet Services

The cost of internet services, particularly mobile data, remains a significant barrier to mobile banking adoption. Efforts should be made to improve internet infrastructure, expand coverage to rural areas, and reduce data costs.

Financial institutions have already started addressing this, and partnering with telecommunication authorities for zero-charge internet usage while using their mobile banking application. This provision, along with others can significantly help mobile banking adoption in Nepal.

Enhance Financial Literacy Programs

Educating the general population about the benefits, functionalities, and security measures of mobile banking is vital. One of F1Soft’s efforts for this is UseMobileBanking.com, which is a platform aimed at teaching and informing the general populace about mobile banking. This platform is available in both English and Nepali.

We have also initiated several BTL activations to inform bank visitors about the benefits of mobile banking, and for answering any queries they might have about the same. However, this will need a concentrated effort between financial institutions, government authorities, and service providers to be truly effective.

Language Localization

Mobile banking apps should be available in multiple languages, catering to the diverse linguistic needs of the population. By offering user interfaces and customer support in local languages, financial institutions can make mobile banking more accessible and user-friendly for individuals who are not proficient in English.

This is a feature available in BankXP, which is the omnichannel solution developed by F1Soft. The language is not limited to only Nepali either, as the feature has the potential to adopt any language the financial institution needs to improve user experience.

Strengthen Security Measures

Addressing concerns related to security is essential to build trust among potential users. The biggest security measure, however, is awareness, and it needs to be focused on informing the public about the dangers of various risks, and how to stay safe.

F1Soft has recently partnered with CIB for the same and produced an awareness video that seeks to educate the users about the different scams proliferating the market and how to stay safe from them.

Streamline User Experience

Improving the user experience of mobile banking apps can significantly enhance adoption rates. This is something that F1Soft holds in high priority, and we have been focusing on designing intuitive, user-friendly interfaces that are easy to navigate and understand.

Simplifying the registration process, and transaction flows, and adding features like fingerprint or facial recognition for authentication can make mobile banking more convenient and appealing to users.

Collaborate with Merchants and Service Providers

Encouraging more businesses, including small and medium enterprises, to adopt mobile banking solutions can create a favorable ecosystem for mobile banking.

There are over 1.2 million Fonepay merchants in the market right now, even in areas such as Sunauli and Jogbani border where Nepali customers are prevalent. However, the user side of the equation also requires awareness regarding the availability of this option, and steps are required to increase the usage of digital payments for increased mobile banking adoption.

Government Support and Regulation

The government can play a vital role in promoting mobile banking adoption by implementing supportive policies and regulations. These policies should focus on encouraging innovation, safeguarding user interests, and fostering competition among financial institutions to provide better mobile banking services.

Current NRB guidelines are focused on improving mobile banking usage, with NRB increasing mobile banking transaction limits, and the governor of NRB promoting the use of mobile banking themselves. The latest budget is also rumored to have numerous provisions for promoting mobile banking usage.

By implementing these strategies, Nepal can further boost mobile banking adoption and empower its citizens with convenient, secure, and efficient financial services. Continued collaboration between banks, technology providers, government bodies, and the public will be essential to drive the growth of mobile banking in the country.