Nepal has a truly unique geography. It’s a small developing nation, sandwiched between two world superpowers. It does get inadvertently drawn into tugs-of-war between the two when they try to establish their influence in the region.

Nepal has not faced the trials and tribulations that its neighbors have faced; our challenges are different. India and China were forced to adopt digital finance, whereas Nepal is slowly but surely embracing it. Let’s take a look at how our neighbors reached where they are, and how we are getting there.

A Look At Our Neighbors

China and India have had turbulent economic pasts. The economies took very different roads, with different policies, history, and geopolitical backgrounds shaping the nations into what they are today. But one thing has been common in both nations: the unprecedented rise in digital payment systems.

China’s economic development can be traced back to the days of Mao Zedong, with his Great Leap Forward revolutionized the industrial landscape of the nation. Although criticized for its socio-cultural impact, the initiative propelled China into a global superpower. It also closed the nation off into a one-party, authoritative, and highly monitored state, with the government tracking all its citizens.

China may be cut off from the global internet with heavy censorship, but even the CCP realizes the potential of the technology and has facilitated home-grown substitutes to popular social media platforms as services. As such, it needed a substitute for payment networks. In came WePay, UnionPay, and AliPay. In line with the government’s policy of tracking the movement and activities of its citizens, digital payments were heavily promoted over paper money in the country.

India on the other hand, was dragged into the digital payment prominence very recently. Two things accelerated the transition: Jio and demonetization.

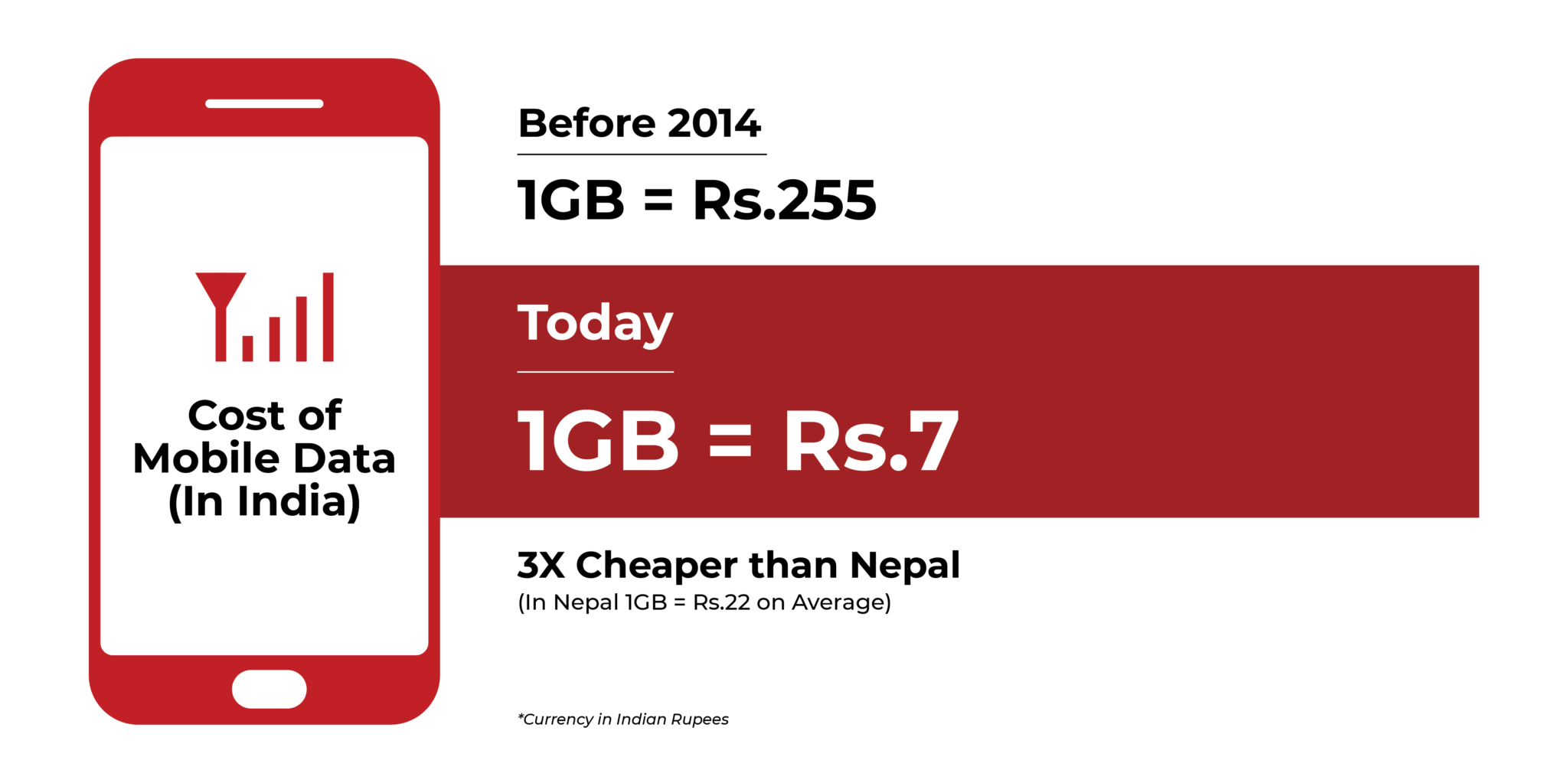

Mukesh Ambani launched his flagship communication company, Jio, in 2014, with a 90-minute speech that promised to revolutionize the internet landscape in the nation. Before 2014, 1 GB of data cost ₹ 255. Today, it costs less than ₹ 7 (Which is 3 times cheaper than in Nepal, where it costs NPR 35 on average). This means that in India, you can watch an hour’s worth of YouTube video in HD for just ₹ 7 today.

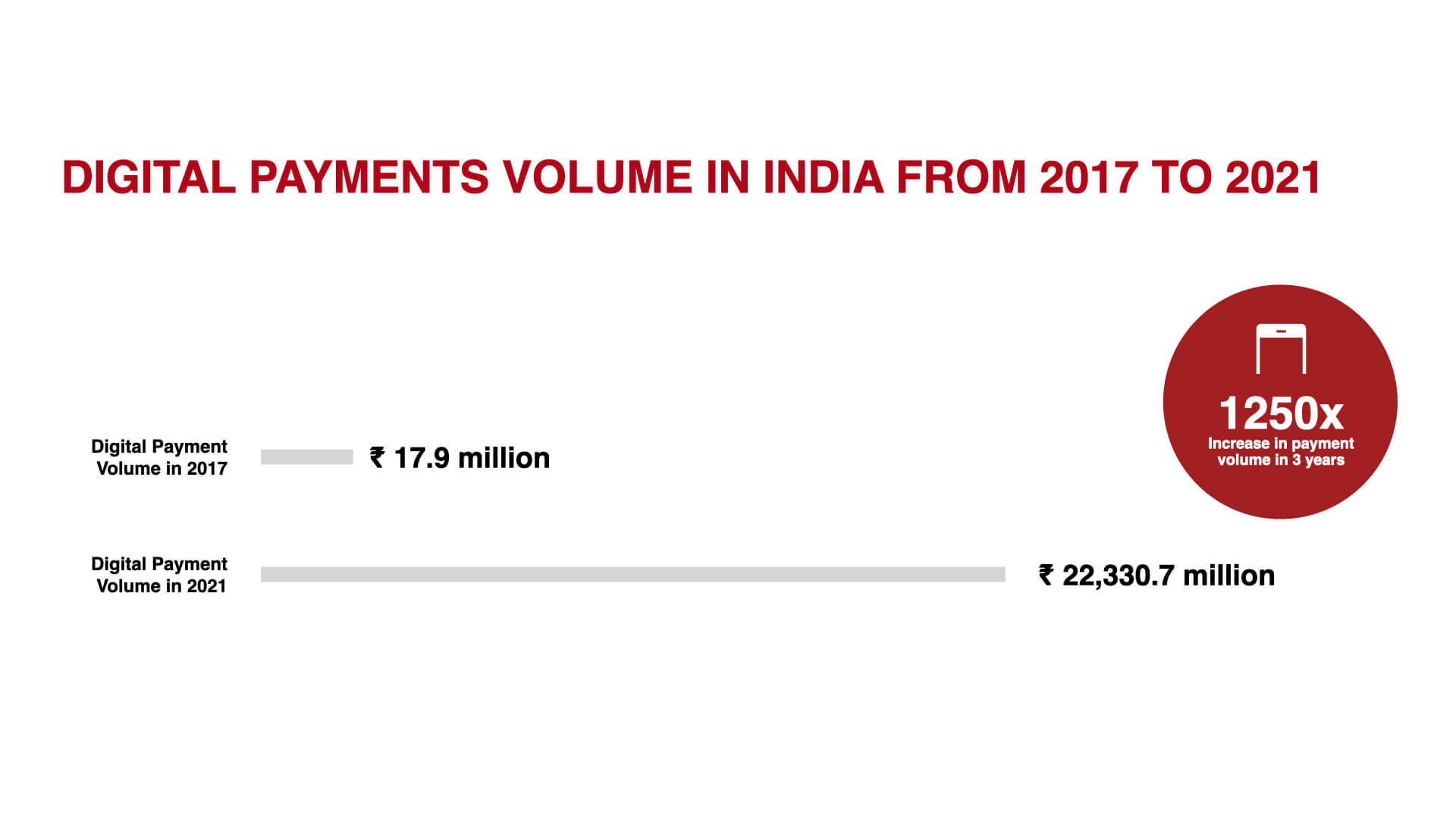

The second phenomenon was the 2016 demonetization of the 500 and 1000 rupee notes, which caused a national shortage of paper notes and forced the nation to go digital. PayTM, an online wallet that recently launched, even took out full front page newspaper ads thanking Narendra Modi. The move was not well received, but the result was definitely apparent: India was going cashless, and fast. In fact, digital payments rose from a total of ₹ 17.9 million in 2017 to ₹ 22,330.7 million in 2021, which is an exponential 1250x increase.

Unlike its neighbors, Nepal is not adopting digital payments because it has to, but because it wants to. We are slowly embracing digital payments on our own timeline, accelerated by the pandemic of course. And although proliferation was slow at first, there has been exponential increases everywhere, from users, merchants, to even service providers.

Where Does Nepal Stand?

Contrary to popular belief, digital payments in Nepal is not very new. It has a history of over two decades in Nepal. Himalayan Bank introduced Nepali credit and ATM cards in 1995, and Kumari Bank was the first bank to provide internet banking in 2002. F1Soft was the first provider of SMS banking services, starting with Laxmi Bank in 2007. eSewa was a gamechanger not just in Nepal, but in Southeast Asia, being the first digital wallet in the region. Today, not just banks, but all financial institutions, big or small, have digital payment options.

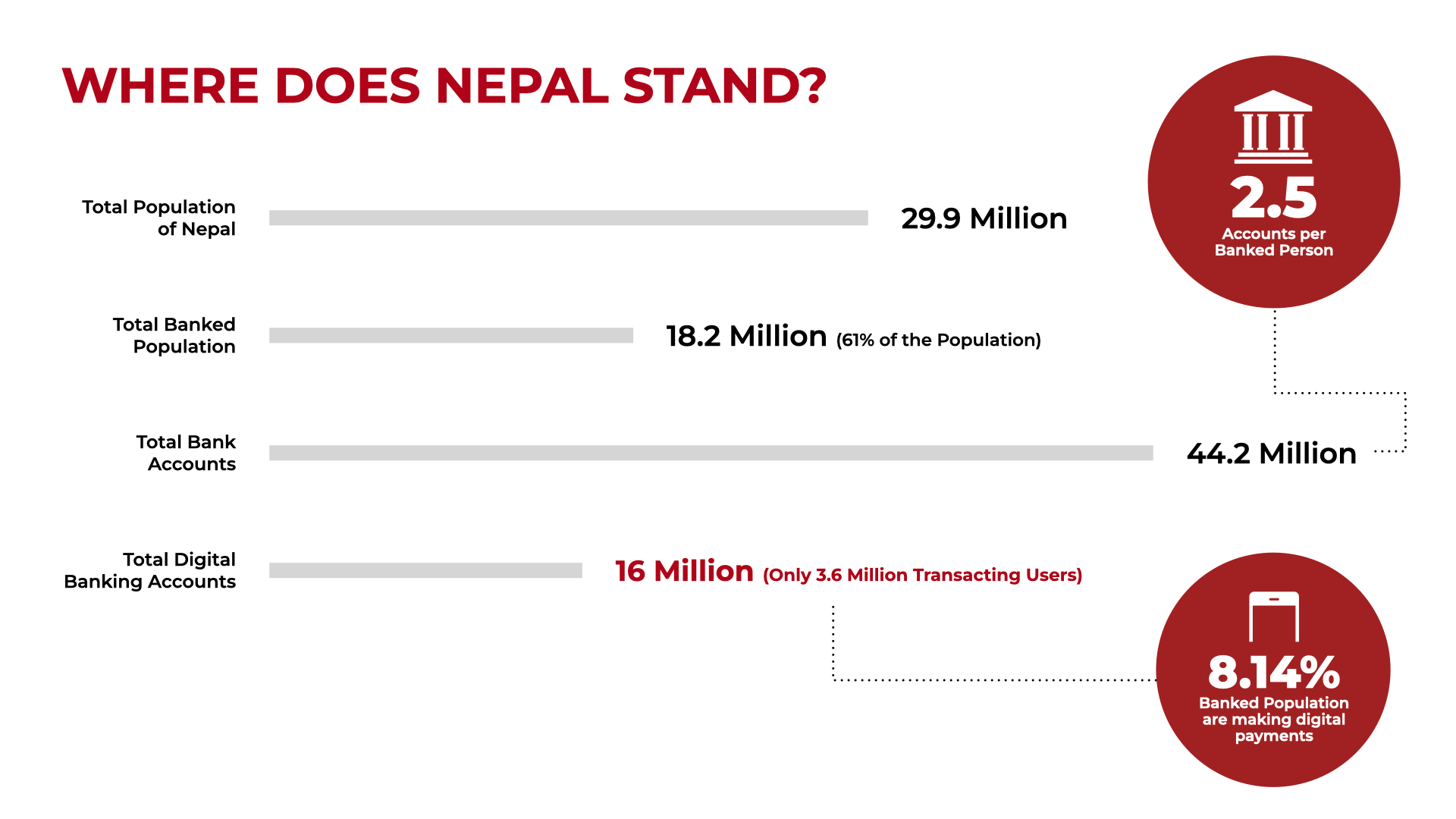

However, having technology is simply not enough. Looking at the numbers, out of the 29.9 million population of Nepal, 18.2 million people (61% of the population) have a bank account. Despite this, there are a total of 44.2 million bank accounts, which means there is an average of 2.5 accounts per banked person.

Out of the total bank accounts, 16 million bank accounts have registered for mobile banking, and only 3.6 million mobile banking accounts are transacting actively. This means that only 8.14% of total bank accounts are making digital payments. Adoption is the biggest challenge Nepal faces.

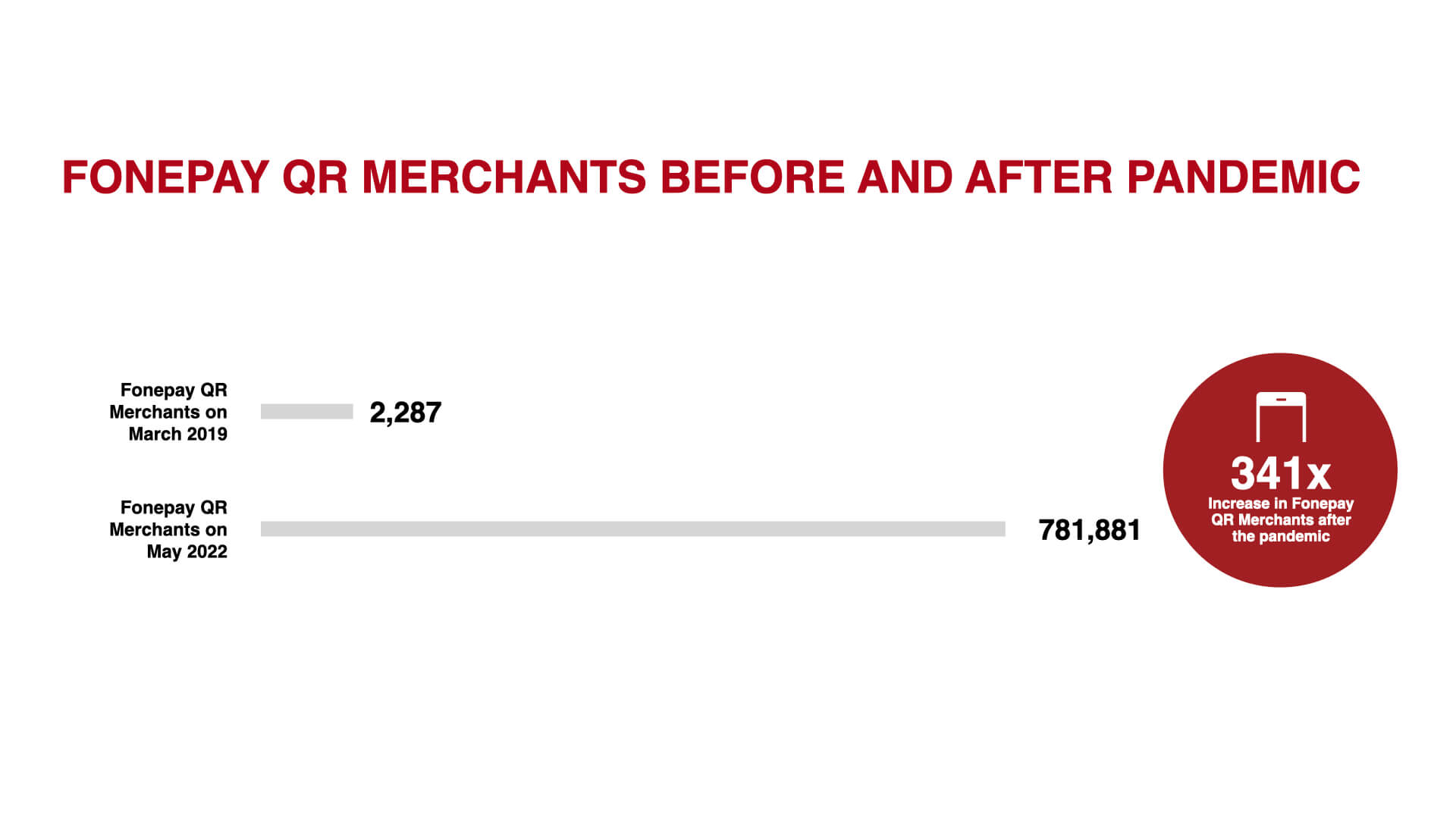

This is where the pandemic changed everything. Adoption spread rapidly, and digital payments have started becoming more and more widespread. Before the pandemic, there were only 2,287 Fonepay Merchants that took QR payments. Now, there are over 780,000 merchants, which is a 341x increase in just under 3 years. Fonepay reported a total of NRS. 3.5 Arba worth of transactions through the network on the 2078 B.S. New Year’s Eve alone. Even international Visa cardholders can scan and pay in Fonepay QRs using the mVisa app. Chinese payment apps can also be used in Nepal and are regulated by Nepal Rastra Bank. Scan-and-pay has become so popular that it is currently the subject of multiple viral TikTok skits and reality shows.

The Way Forward

Nepal has the technology and is slowly heating up in terms of adoption too. There is a long way to go before Nepal is labeled a digital payment powerhouse, but it is not impossible. One of the biggest challenges faced in Nepal is the lack of awareness, especially amongst the rural population regarding the advantages of going digital. The rural population is not opposed to digitization, in fact, digital remittances like eSewa Money Transfer are slowly overtaking conventional remittance services due to their convenience and speed.

Hence, the first logical step would be to make the benefits of digital payment systems more apparent. For instance, cash-based businesses such as grocery shops will have an easier time obtaining loans from banks, on the basis of a more visible cash flow as opposed to a system that uses paper cash exclusively. There’s also the benefit of knowing exactly how much money you’ve spent, your spending habits and trends, and making adjustments accordingly. People do not really know how digital finance can impact their personal and professional lives, and learning the same can go a long way.

The next step would be to make digital payment systems more advantageous to use. Nepal Rastra Bank has a number of policies that regulate digital finance, but very few that promote its use. As such, shifting policy priority towards incentivizing the use of digital payment methods should be highly impactful.

Finally, constant national innovation in digital finance is a must. Even though most financial institutions have mobile apps, none of the apps are in the Nepali language. This is a major deterrent for rural adoption and is something that must be prioritized. And although mobile banking apps allow you to do a number of tasks that would require a bank visit, they have not truly not becoming an “alternative”, but rather functioning as an add-on. Foneloan, an instant, collateral-free loan available from mobile banking apps (a first in the country), is becoming popular in the market by simplifying credit access. Similar innovation is required so that digital payment systems can truly become an alternative to traditional banking.

All in all, Nepal is on the right track. The road might be rocky, but rocky roads are something we are familiar with, and we are walking on the path with gusto. The pandemic was a major event that accelerated the adoption, and now it is time to stoke that flame rather than let it die, and make Nepal a digital payment powerhouse.