In today’s fast paced world, where convenience is considered to be a major priority, mobile banking has become an innovation technology that is transforming how we handle our finances. Mobile banking brings unparalleled convenience to our fingertips, allowing us to effortlessly check account details, balances, transfer funds, and pay bills anytime, anywhere. Managing finances into our daily lives has never been simpler. With just a few taps on a smartphone, mobile banking grants us instant access to a wide range of banking services.

Understanding Customer-Centric Mobile Banking

Customer-centric mobile banking is a paradigm shift in the financial landscape, placing the customer's needs and preferences at the forefront of banking services. Unlike traditional banking models, customer-centric mobile banking leverages technology to create a seamless and personalized experience. It revolves around accessibility, ensuring that users can manage their finances with ease through a user-friendly mobile application. The emphasis on a personalized user experience means that the application adapts to individual preferences, offering tailored insights.

This approach not only enhances convenience but also fosters a sense of trust, making customer-centric mobile banking a transformative force in modern banking. From user interfaces to security concerns, every aspect is designed to enhance banking experience with customer-centric mobile banking. Without further delay, here’s how customer-centric mobile banking with alway puts you first.

1. Accessibility and Convenience

Mobile banking brings the bank to the customer's pocket, enabling them to access a myriad of services with just a few taps on their smartphones. Whether it's checking account balances, transferring funds, or paying bills, the convenience factor is unparalleled. This accessibility ensures that customers have control over their finances anytime, anywhere, reducing the reliance on traditional brick-and-mortar branches.

2. Seamless Transactions

Gone are the days of standing in long queues or waiting for business hours to perform a transaction. Mobile banking ensures that transactions are quick, secure, and hassle-free. Whether it's transferring money to a friend, paying for a purchase, or managing investments, the process is streamlined to make the experience as smooth as possible. This not only saves time but also enhances customer satisfaction.

3. Customer-Centric User Experience

One of the key features of customer-centric mobile banking is its ability to provide convenient user experience. The user experience of mobile banking has become a cornerstone of modern financial services, seamlessly integrating advanced technology with user-friendly design. With a user-friendly interface, it ensures that customers can effortlessly access and manage their financial transactions with just a few taps on their smartphones. This simplicity not only caters to those who are technically proficient but also accommodates users with varying levels of digital literacy.

4. Enhanced Security Measures

Security is a top priority in the realm of mobile banking. Advanced encryption technologies and biometric authentication methods provide a secure environment for customers to conduct their financial activities. The customer-centric approach extends beyond convenience to ensure that users can trust the mobile banking platform with their sensitive information, fostering a sense of security and confidence.

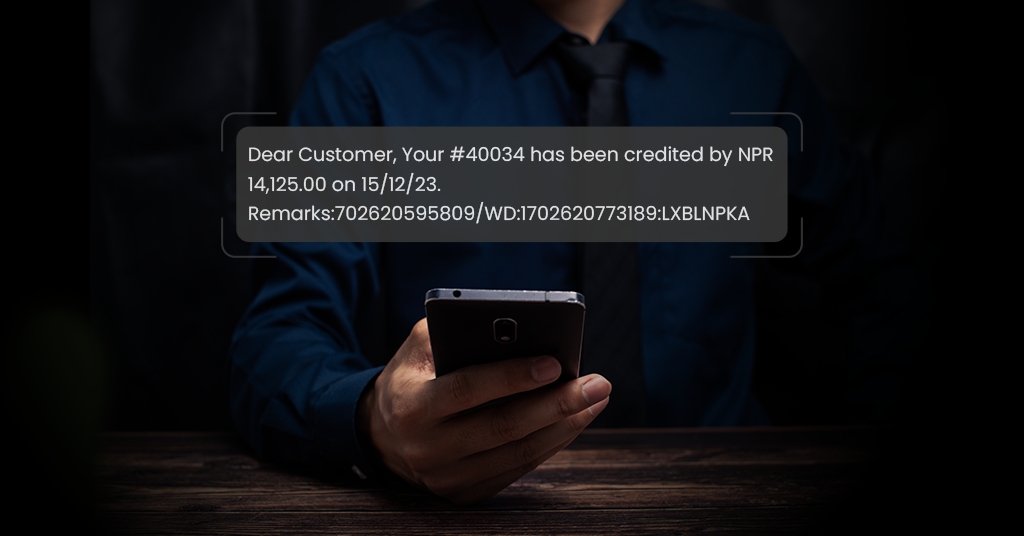

5. Real-time Updates and Alerts

Mobile banking keeps customers informed in real-time about their financial transactions. From receiving alerts for account activity to updates on the latest promotions or changes in interest rates, customers stay in the loop effortlessly. This proactive communication ensures that users are always aware of their financial standing, helping them make informed decisions.

6. Continuous Innovation

The customer-centric approach of mobile banking is reflected in its commitment to continuous innovation. Banking apps regularly update their features to align with evolving customer needs and technological advancements. Whether it's integrating artificial intelligence for predictive analysis, or incorporating latest features for enhanced user interfaces, mobile banking platforms strive to stay ahead of the curve.

Customer-centric mobile banking is not just a technological advancement; it's a paradigm shift in the way we interact with our finances. By putting you first, mobile banking platforms aim to make banking a seamless, personalized, and empowering experience. As the digital landscape continues to evolve, mobile banking stands as a testament to the financial industry's commitment to providing you with the tools you need to thrive in an ever-changing world.