Human beings are inherently motivated by the pursuit of partnerships. Whether in life, relationships, or business, interaction and learning from others are crucial for personal growth and development. Partnerships play a significant role in this regard. This principle is equally applicable in the constantly evolving sphere of financial services. The collaboration between Banks & Financial Institutions(BFIs) and innovative fintech companies has arisen as a dynamic catalyst. It presents a spectrum of both opportunities and challenges.

This phenomenon takes on particular importance in nations like Nepal. Here, the complex socio-economic landscape demands a tailored strategy for integrating fintech solutions unique to South-Asia. In this context, partnerships become an essential means of achieving harmonious alignment between established financial institutions and cutting-edge fintech innovations.

In this case, we can view India as a progressive adapter. India, a global leader in fintech adoption, underscores the need for bank-fintech collaboration. According to the Times Of India, India is projected to have a $1.3 trillion market by 2025, driven by digital adoption, structural reforms, and regulatory support, thereby spearheading a disruption in financial services. Fintechs focus on underserved segments while evolving for sustainability, urging collaboration with banks. Banks harness trust, resources, and customer bases, and fintechs contribute technology stacks and insights.

Breaking Misconception

Nepal has always exhibited digital adeptness in the banking industry. People tend to believe that the pandemic boosted digital adoption. While this is true to some extent, it's not wholly applicable.

As Subash Sharma, F1Soft Group Director states, in Nepal, BFIs were already integrating the digital tools provided by Fintechs even before the pandemic compelled everyone to do so. Nepal stood out as one of the few countries where even the smallest financial entities offered a mobile banking app. Therefore, the resources and adoption were in place. However, what the pandemic accelerated was the adoption among consumers.

Prior to the pandemic, consumers were hesitant to try something that appeared new to them – digital banking. Nonetheless, the pandemic rendered other options obsolete, compelling consumers to embrace digital banking. As the user base expanded, people recognized the ease and convenience of digital banking solutions. Even after the necessity for digital processes diminished, people continued with it because of the comfort and benefits provided.

A Look at History

The Bank and Fintech collaborations that date back to earliest as 2004 are what enabled Nepal to reach its current position in digital adoption. BFIs have been integrating digital means and automation since long ago. However, BFIs had other priorities before creating automation solutions and technological development, but the customers had a need for these solutions. This is where Fintechs, notably F1Soft, one of the prominent names in Nepal's Fintech sector, entered the picture. F1Soft took on the development risks that the banks couldn't allocate time to, due to their business priorities, and provided digital banking solutions.

In 2004, the internet banking that banks were adopting was slow due to the underdeveloped internet infrastructure. Consequently, F1Soft introduced SMS banking as prepaid phones were just launched, which was much more adept and preferable at that time. There was a gap between what the consumers needed at the time and what was being provided. F1Soft recognized the gap and bridged it with its technological solutions, but that itself would not have been possible without the base of trust and legitimacy that Banks provided. Consumers were more likely to adopt the Fintech solutions because the Banks were collaborating with them. From this fact itself, it is evident that the collaboration between BFIs and Fintechs has a historical foundation and has led to substantial progress so far.

Challenges in Modern Day

Collaboration opens the door to numerous new opportunities, but it also brings forth challenges born from this partnership. When two or more entities come together, clashes of values can arise, due to their distinct priorities. For banks, it's about maintaining business operations and caring for their customers, while Fintechs prioritize constant innovation. Given these fundamentally different cores, clashes are almost inevitable, making collaboration a complex endeavor.

Within the ecosystem that banks operate, there exists a delicate balance. BFIs are perpetually competing with one another, while Fintechs strive to cater to each bank's specific needs. Sustaining this equilibrium can prove to be intricate. Fintechs must provide value by offering unique solutions that align with what consumers desire. To succeed, Fintechs must also foresee emerging trends before they manifest. In Nepal, Fintechs are dedicated to being early trend adopters and pioneers in innovation.

Consider eSewa as an example: it was the first company in Nepal to introduce utility bill payment services. Recognizing the prevalent challenges faced by Nepali citizens in this domain, eSewa promptly provided an easy solution. Consequently, consumers embraced this service enthusiastically. Observing the sector now, it's evident that almost every company offers utility bill payment options—a trend that has spread across South Asia. eSewa's success stemmed from its ability to identify a challenge, devise a solution, and execute it effectively.

Nepal faces an additional challenge due to its infrastructure and economy. With uneven literacy rates and overall development, achieving financial inclusion remains a struggle. Incorporating Fintech solutions requires a certain level of knowledge and awareness, which has been difficult to attain in some areas. Nevertheless, strides have been taken to address this issue. Initiatives like those by Nepal Rastra Bank and F1Soft are heightening awareness about financial inclusion, propelling us in the right direction.

Navigating Regulatory Dynamics

While showcasing remarkable progress, the evolution of Nepal's fintech landscape is significantly influenced by regulatory forces. Collaboration between BFIs and Fintechs holds transformative potential but operates within the framework set by financial regulations. These regulations serve as a guide, ensuring compliance and security for innovative solutions. The interplay between technological advancement and regulatory compliance is crucial. Fintech companies must adeptly navigate these regulatory forces, fostering trust and credibility. Regulatory support bolsters effective models for data sharing and governance.

In Nepal, most regulatory efforts are directed towards validating payments. While this supports BFIs and Fintech collaborations, it's crucial to recognize that Fintech's potential extends beyond payments, encompassing diverse opportunities.

Revealing Untapped Fintech Potential

Amid Nepal's fintech landscape, a void exists between technology-capable players and risk-takers. Bridging this gap demands holistic strategies that not only provide services but also enhance value. Prioritizing technologies and educating customers assume pivotal roles in this endeavor. This is where Fintechs are constantly working with a customer-oriented viewpoint, which is pivotal for Fintech evolution. Innovation begins by understanding consumers' comfort zones. Fintech companies can seamlessly transition by aligning with user habits and preferences, thus ensuring a smooth integration of new technologies. To read more about this, Reshaping Finance with Artificial Intelligence: Trust Building and Redefining Banking, can be a valuable source of reference.

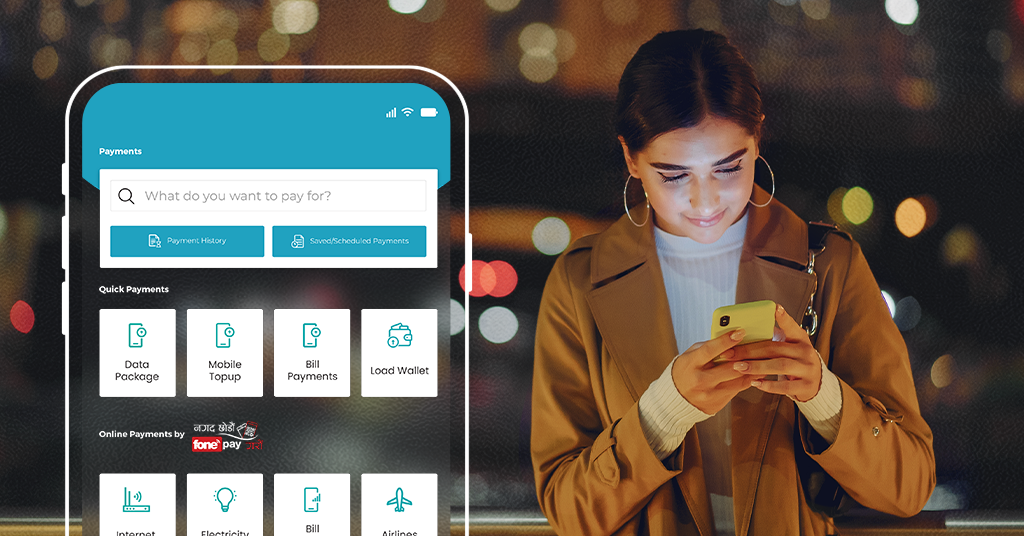

As Nepal's financial panorama transforms, catering to the tech-savvy younger generation also becomes imperative. Their demand for intuitive services propels the fintech revolution further. Navigating this landscape necessitates balancing innovation with practicality. Thanks to the workings and adoption of Fonepay, the present generation has embraced the QR code trend. When signing up for BFIs, the first step for the youngsters is always downloading the app. This approach prioritizes easy automation, leading to an observable shift with Banks adopting more digital services provided by Fintechs. As stated by Subash Sharma, F1Soft Group Director, other potential areas where Fintechs could collaborate with Banks include investments—a domain that remains relatively unexplored in Nepal.

By joining forces, Fintechs and Banks can revolutionize investment accessibility, making it more inclusive and user-friendly. The application of innovative technologies could simplify investment procedures, provide real-time insights, and cater to diverse risk appetites. Other collaborations can span various domains like PoS, lending, and insurance, expanding reach and innovation. The potential is never ending.

In summation, the interplay between BFIs and Fintech entities is reshaping Nepal's financial sector. By contextualizing solutions, fostering collaborations, and harmonizing with consumer preferences, Nepal's fintech journey is poised for profound growth. As the nation advances, embracing these collaborations while addressing challenges will invariably chart a course towards a more inclusive, technology-driven financial future. It's important to recognize that BFIs and Fintechs are not each other's competition but two parts of the same coin that, when together, create value.