Mobile banking in Nepal is getting more popular everyday. According to the monthly report published by PSD – Nepal Rastra Bank, registered mobile banking customers in Nepal number at around 1.7 crores, which is almost double the number of debit and credit card holders. However, even though these customers are registered, only a small fraction of them are actively transacting.

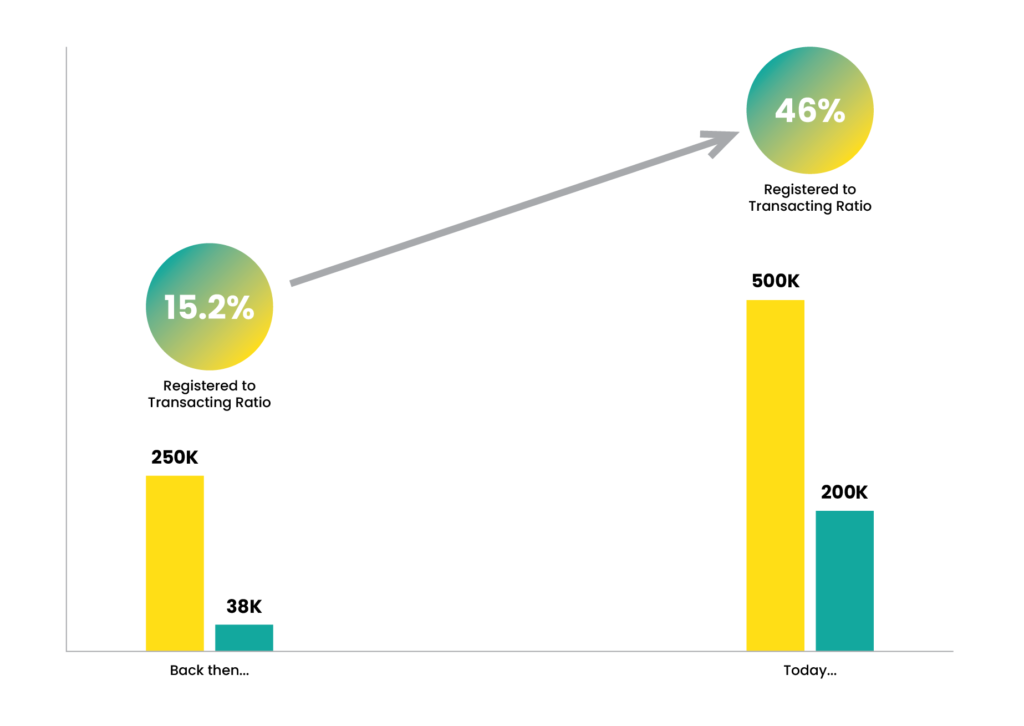

Siddhartha Bank is a financial institution that boasts a wide base of registered mobile banking users, and also has one of the largest number of active users too. Having over 500K active users up to Jestha 2079, they have the highest registered-to-transacting ratio of 46% in financial institutions having over 200K active mobile banking users.

This is a staggering number, and to understand what led the bank to have such success in terms of engaged users, we sat down with Mr. Suresh Maharjan, Head Business Support & Payment Solutions. Here’s what we found out.

1. Focusing on Enrollment is Not Enough, Engagement is of Paramount Importance

Siddhartha Bank segregates mobile banking initiatives into three distinct segments: enrollment, activation, and engagement. Initially, Siddhartha Bank was focused solely on enrollment activities at the expense of the other two.

“We had over 250K registered users, and only 38K who were actively transacting”, said Mr. Maharjan. “This forced us to introspect whether this strategy was good enough or not, since our customers weren’t really getting any benefits.”

It wasn’t the best approach, and forced the bank to reevaluate their methods. To improve customer engagement in mobile banking, Siddhartha Bank started generating lists of customers who have registered for mobile banking and have active accounts, but were not using mobile banking.

“We dedicated resources to calling these people and personally asking them why they weren’t using mobile banking” explained Mr. Maharjan. “We found out that lack of awareness was the top reason by a long way, and started teaching people how to download, activate, and do mobile top-ups through Siddhartha BankSmart directly from these calls.”

This approach boasts a 29% conversion rate, and has increased the registered-to-transacting ratio of the bank from 15% to 46%. The first time this strategy was implemented, the number of transacting customers jumped from 38K to over 70K. The list is refreshed every 3 months, and this is an ongoing initiative that is still yielding good results for the bank.

2. Customer Issues are Given Top Priority

Siddhartha Bank has invested heavily in establishing a world-class contact center. The contact center is online from 7 AM to 10 PM throughout the year, and has state-of-the-art technology and processes to facilitate customer care.

“Just having resources and systems is not enough”, Mr. Maharjan elaborated. “We’ve also invested a lot of time and effort into making sure that the contact center is being used to its full potential.”

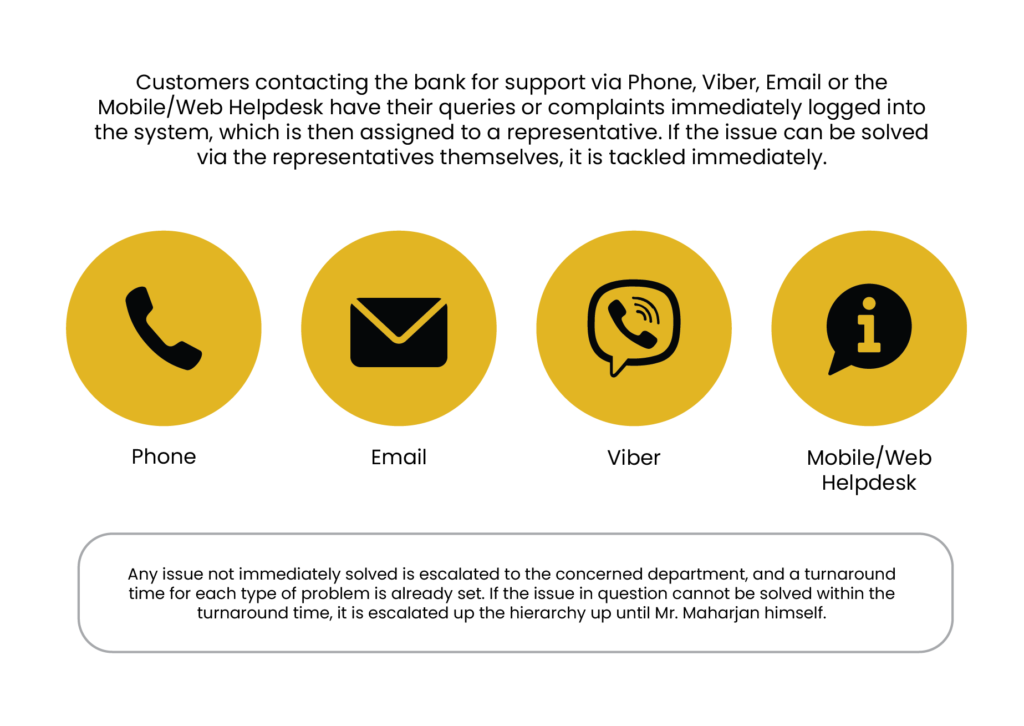

Customers contacting the bank for support via Phone, Viber, Email or the Mobile/Web Helpdesk have their queries or complaints immediately logged into the system, which is then assigned to a representative. If the issue can be solved via the representatives themselves, it is tackled immediately.

“It is important to keep the customers informed regarding the status of their complaints”, said Mr. Maharjan. “Even if it cannot be immediately solved, we send the customers an email specifying how long it would take to solve the issue. If the issue is solved, we notify the customers regarding the same as well.”

Any issue not immediately solved is escalated to the concerned department, and a turnaround time for each type of problem is already set. If the issue in question cannot be solved within the turnaround time, it is escalated up the hierarchy up until Mr. Maharjan himself.

“I used to get a lot of issues escalated to me when we initially set up the system. Now, the team has enough training and experience that I barely get any issues assigned to me”, said Mr. Maharjan.

Customers love the prompt, well-crafted responses and the effort that Siddhartha Bank puts into resolving their issues. A robust system ensures that no case goes unaddressed. “Siddhartha Bank has by far the best customer care out of all the banks I engage with”, said one user we talked to. “Their email replies are well-crafted, and I am updated regarding the status of all of my issues. They tell me exactly how long it takes to solve my issues, and also inform me after the issue is solved.”

However, there are still customers who remain dissatisfied with the service. Siddhartha Bank also makes sure any customers who rate their service dissatisfactory are immediately contacted and understand the reason for their dissatisfaction.

“There have been cases where issues we’ve marked as resolved have not actually been resolved, however rare that is.”, explained Mr. Maharjan. “By contacting customers who are dissatisfied, we are able to catch these issues and resolve them immediately.”

For a system that resolves over 15K issues per month, the dissatisfaction rate is very low, and many customers change their reviews after they’ve been contacted and their issues readdressed. This initiative has definitely helped the bank become not just a leader in mobile banking, but a leader in banking overall.

3. Investment in Resources To Enable and Motivate Customers

“We set up hotspots in over 80% of our branches”, Mr. Maharjan informed us. “Customers were unwilling to use their own data to download and activate the app at the bank, and our pilot effort in the Hattisar branch showed us that investing in hotspots showed an increase in both registered and transacting users in that branch.”

Customers of Siddhartha Bank can log into the bank hotspot in most of their branches and activate their service there and then. Siddhartha Bank is also training its desk staff to answer customer queries regarding mobile banking.

“Our staff has all the information regarding our mobile banking app, but just having information is not enough”, said Mr. Maharjan. “Training the staff to digitally enable our customers is of vital importance, and we see it as the logical next step to engage more of our customer base in mobile banking.”

Mr. Maharjan also acknowledged the need to keep customers motivated to keep using mobile banking. “Maybe half of the active users do not need motivation; the convenience of mobile banking will be enough to motivate them to be digitally active. However, the rest of the active users need extrinsic motivational efforts, and we’re looking at loyalty programs to address the same”, he said.

So What Can We Learn?

Siddhartha Bank shows us that just having mobile banking is not enough; resources and time needs to be dedicated to ensure that the customers are making the full use of mobile banking as well. The priority that Siddhartha Bank is giving to engage their mobile banking customers is commendable.

Siddhartha Bank’s efforts in reaching out to customers to enable them to become digitally active has shown huge results, and can act as a blueprint for other financial institutions to increase their own active user base as well. It is a low-risk, high-impact effort that can be easily duplicated and yield excellent output if done properly.

Also commendable is their effort to ensure any customer queries and issues (not just limited to mobile banking) are resolved promptly. Keeping the customers informed about their complaint status is also a brilliant step that keeps them happy, and increases the stature of the bank in all aspects.

Also, providers of mobile banking should realize that mobile banking can be a lucrative source of revenue, and a source of revenue that grows with additional users. Institutions with a large active mobile banking customer base can generate substantial revenue for the organization from registration fees and transaction-based income.

“I won’t deny that promoting mobile banking generates revenue for the bank”, admitted Mr. Maharjan. “However, revenue is not our main priority. Making sure that customers know about and actively engage with our mobile banking infrastructure is the top priority, and any revenue we generate from these endeavors, no matter how significant, is an added bonus and not the goal.”

The lessons learned from the conversation with Mr. Suresh Maharjan might sound easy to implement, but require constant care, monitoring, and evaluation to make sure they are successful. Siddhartha Bank has a great blueprint to enable mobile banking users, and other financial institutions would do well to learn and implement similar practices themselves.