Search Via Bank

Laxmi Sunrise Bank Ltd.

Laxmi Mobile Money

Access your account 24/7 over Wi-Fi, data or SMS for full range of banking services. Go Green with Orange and enjoy paperless and commute-free banking. For SMS banking, please send the message to 32002.

Get started now by downloading Laxmi Mobile Money App.

Laxmi Mobile Money Tutorials

Some useful tutorials, which can guide you to setup, or perform transactions through Mobile Banking.

Tutorial List

How to Activate Mobile Money?

After you have subscribed to Mobile Banking, here is how to activate the service on your phone.

1. Download

Download the Laxmi Bank Mobile Money App from Google Play or App Store.

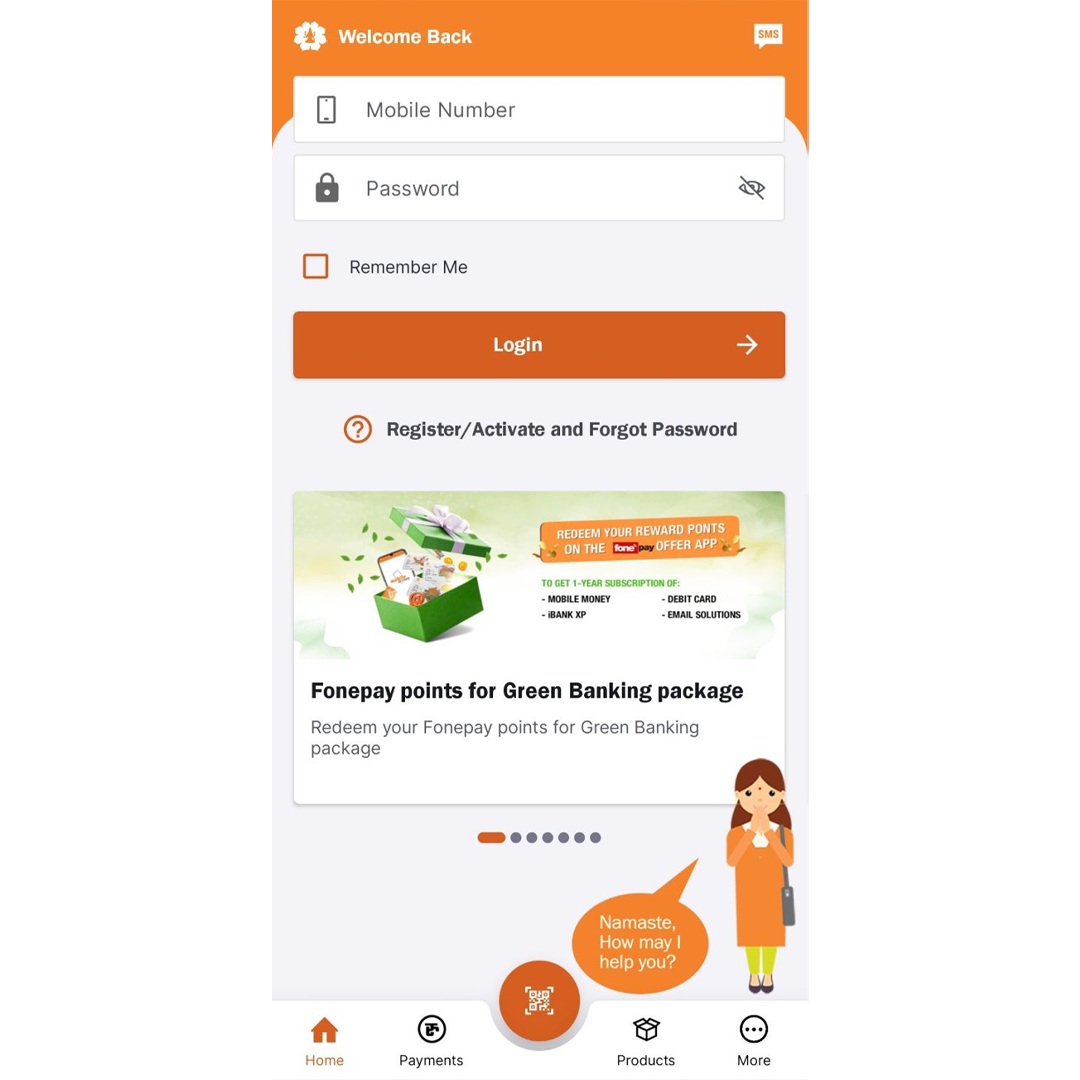

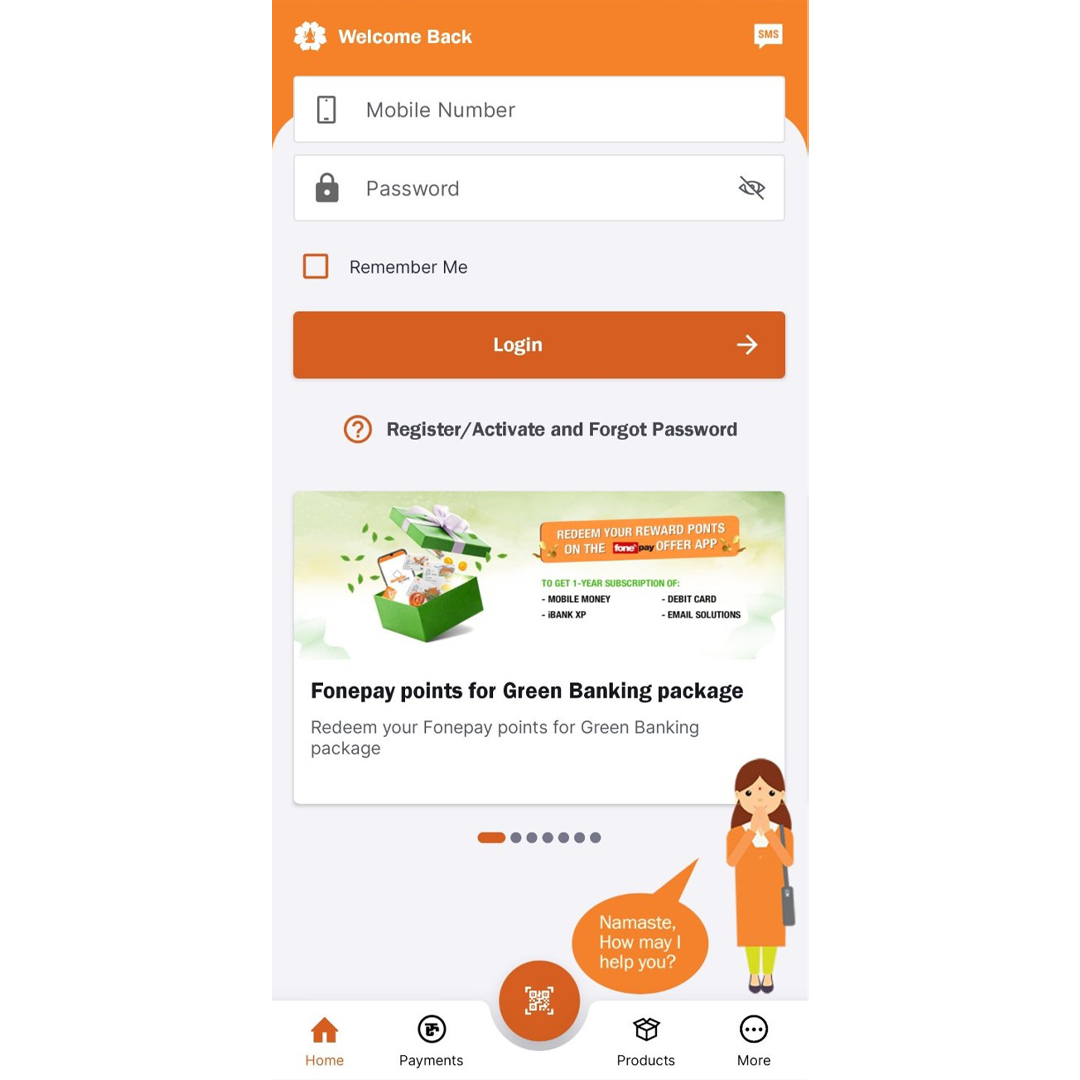

2. Open App

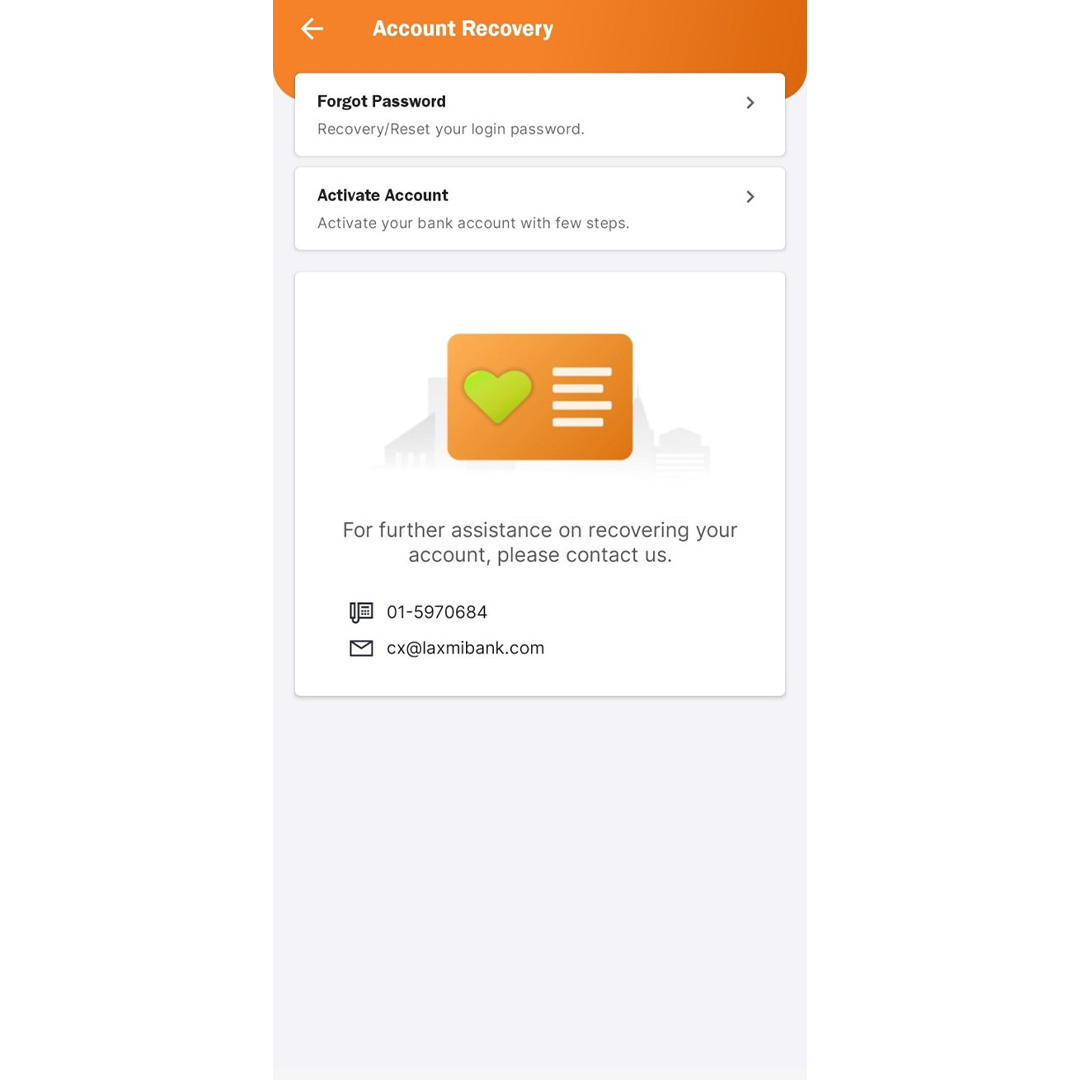

Click on “Register/Activate”.

3. Start Activation

Click on “Activate Account”.

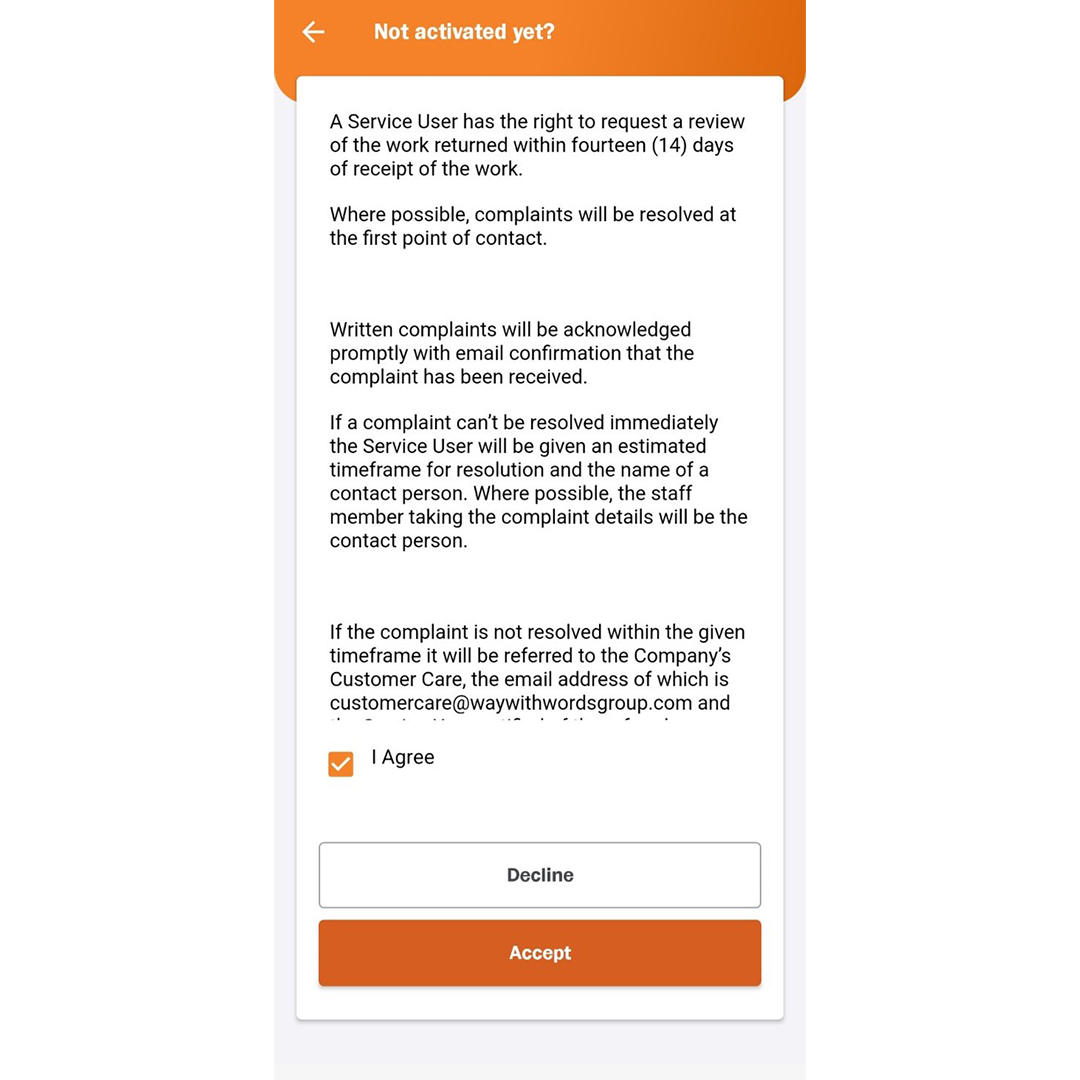

4. Terms and Conditions

Check “I Agree” and click on “Continue”

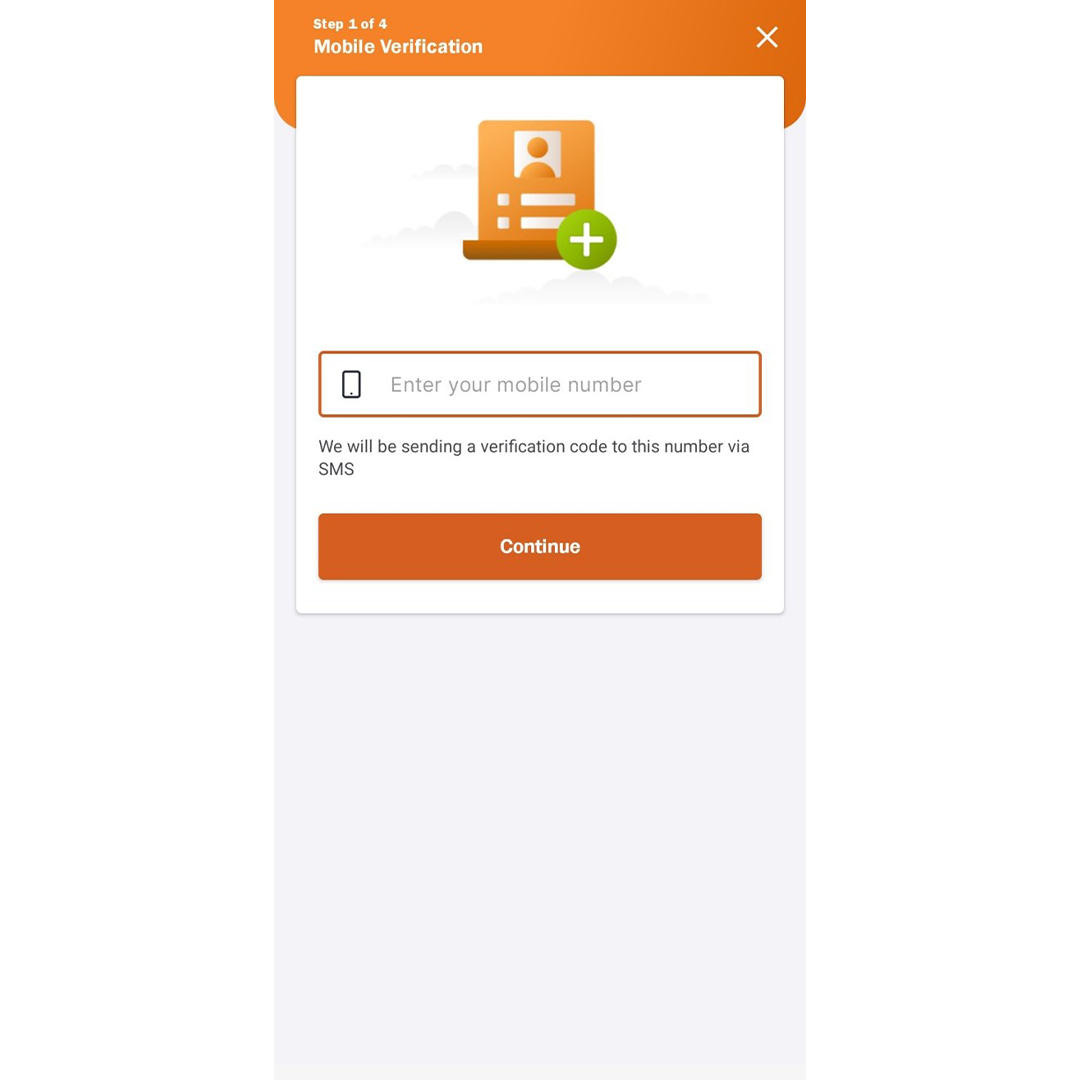

5. Enter Mobile Number

Enter your registered mobile number and click on “Continue”.

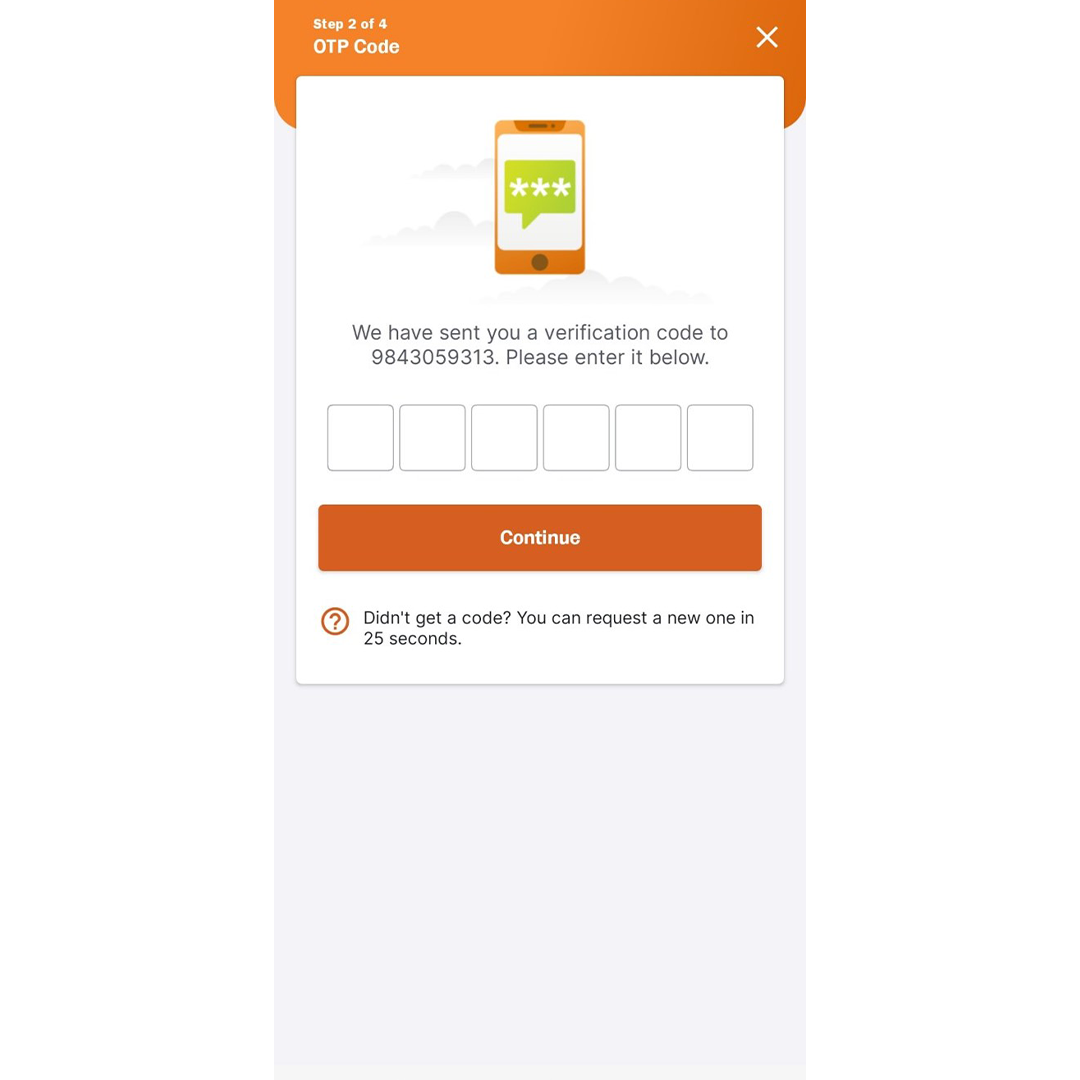

6. Enter Activation Code

An Activation Code will be sent via SMS to your number. Enter the Activation Code and click on “Continue”.

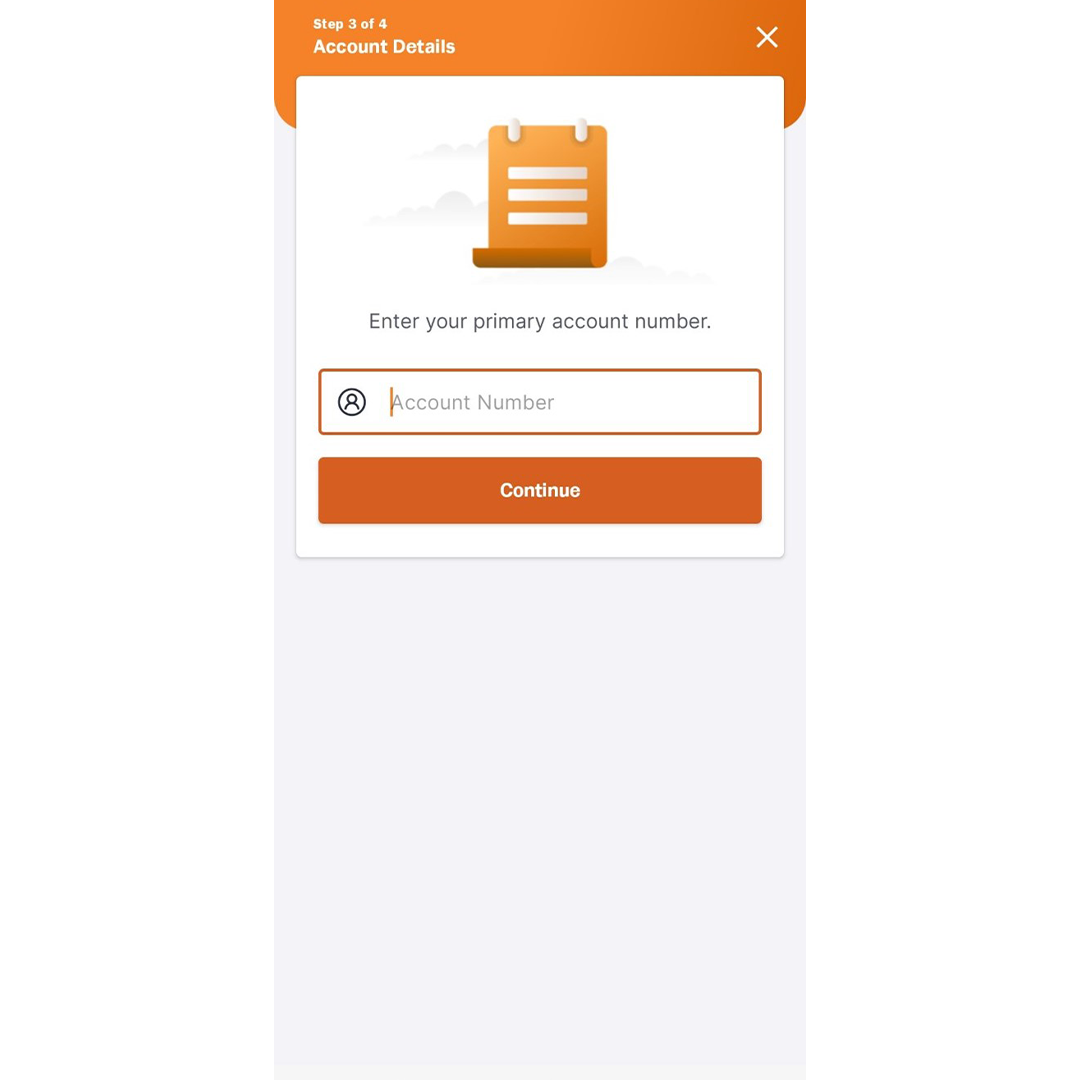

7. Enter Account Number

Enter your Account Number and click on “Continue”.

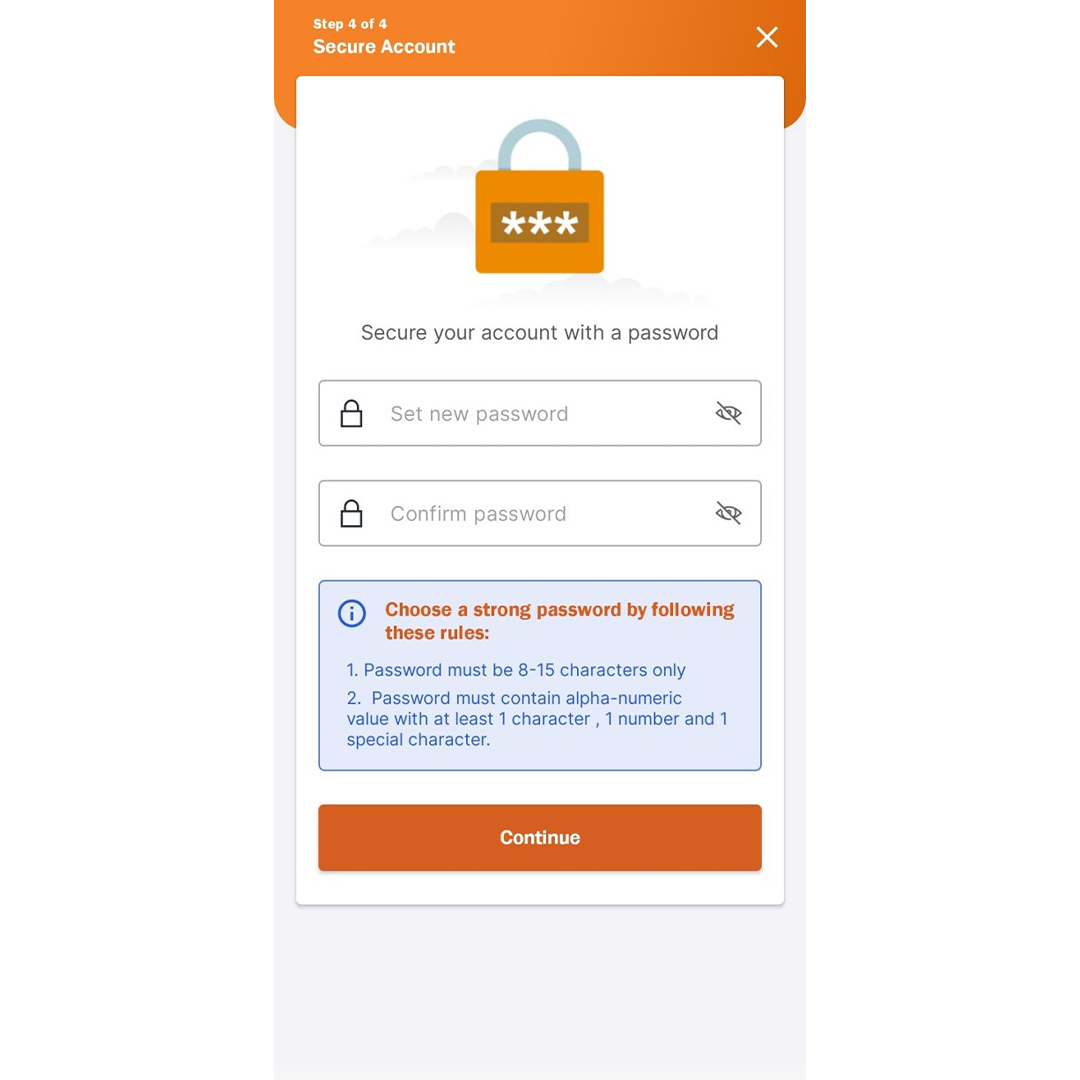

8. Set Password

Set your Login Password and click on “Continue”.

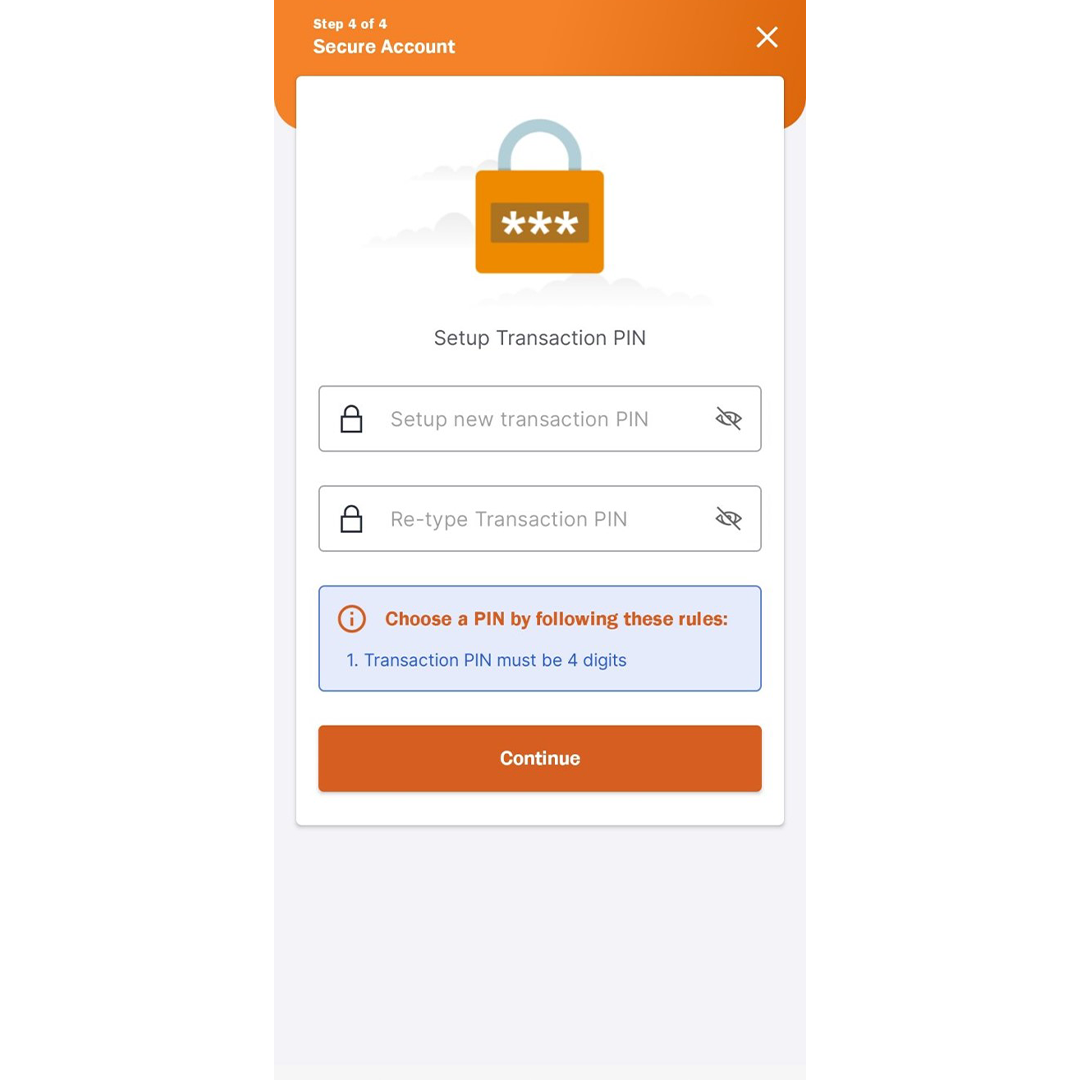

9. Set Transaction PIN

Set your Transaction PIN and click on “Continue”.

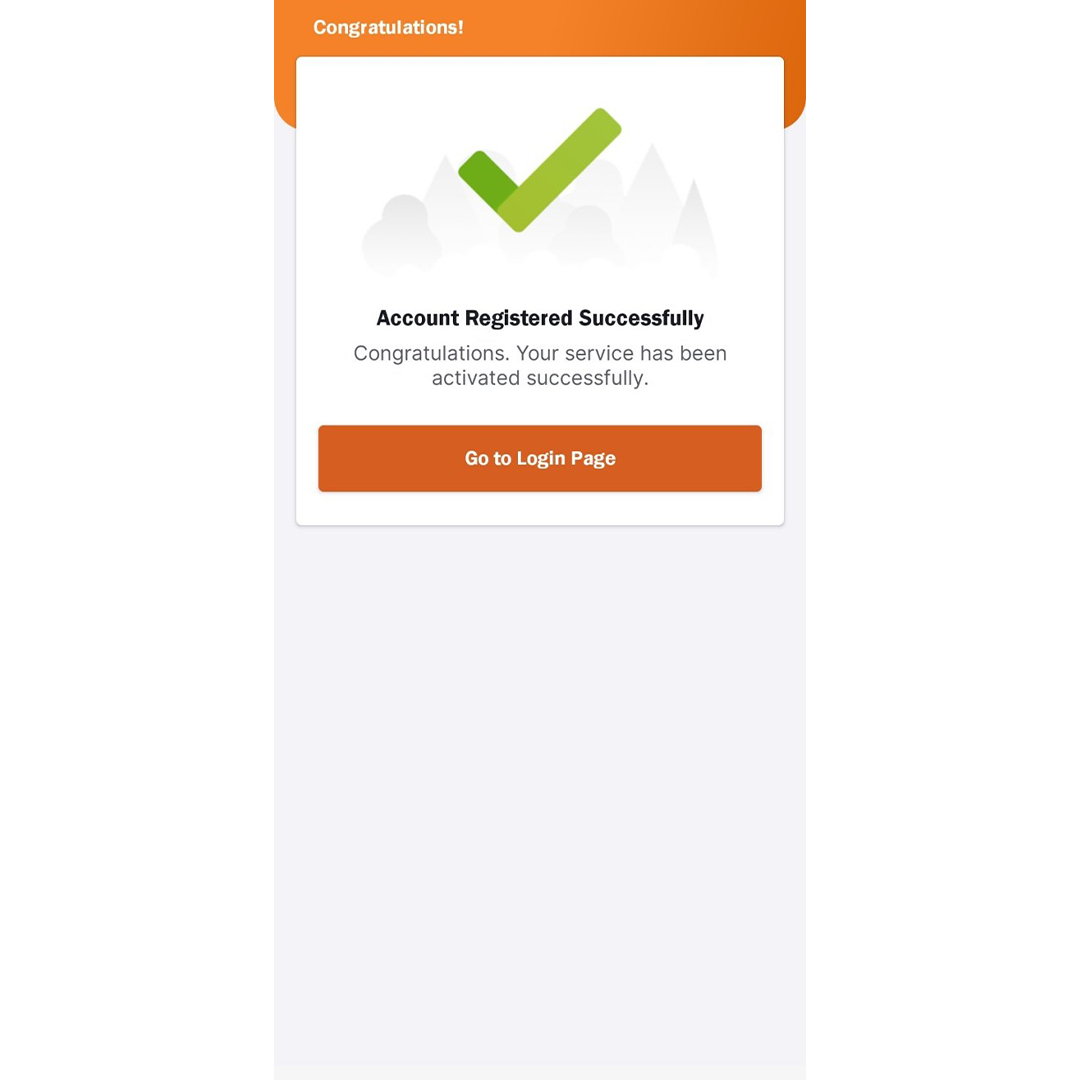

10. Activation Successful

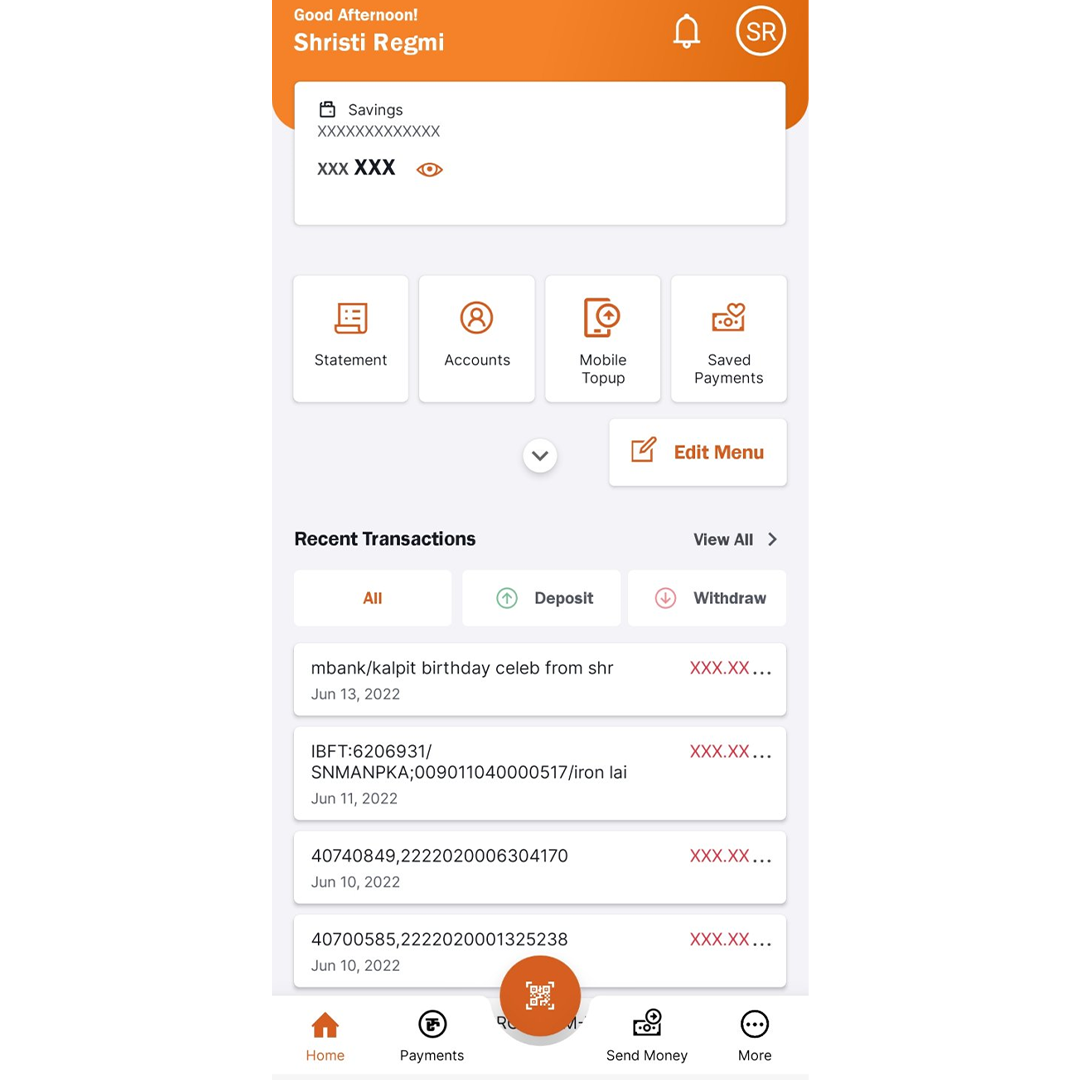

Your Mobile Banking has been successfully activated. You can login using your Mobile Number and the Password you recently set and make transactions.

How to Topup using Mobile Money?

After you have activated your Mobile Banking, here is how to use the topup service.

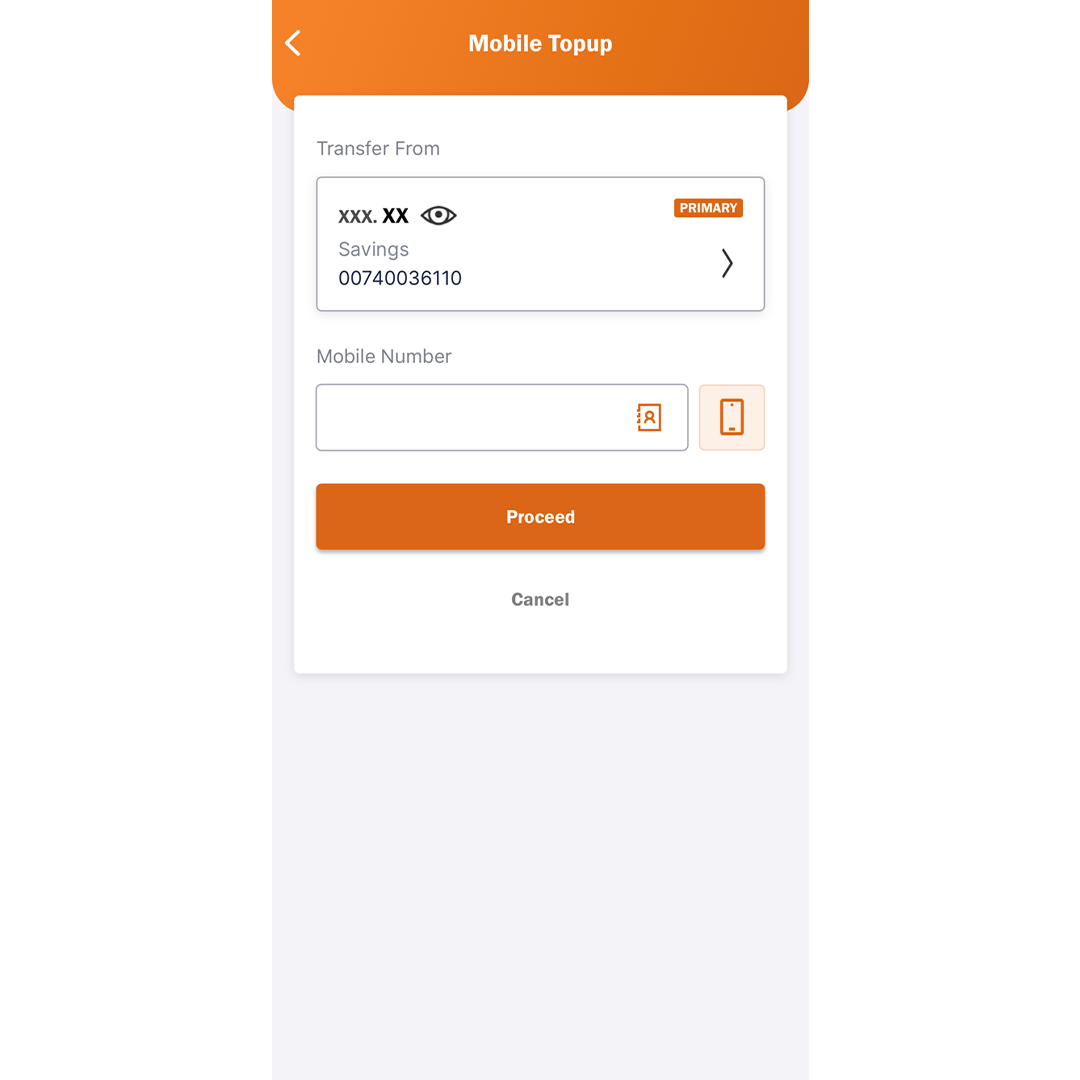

1. Step 1

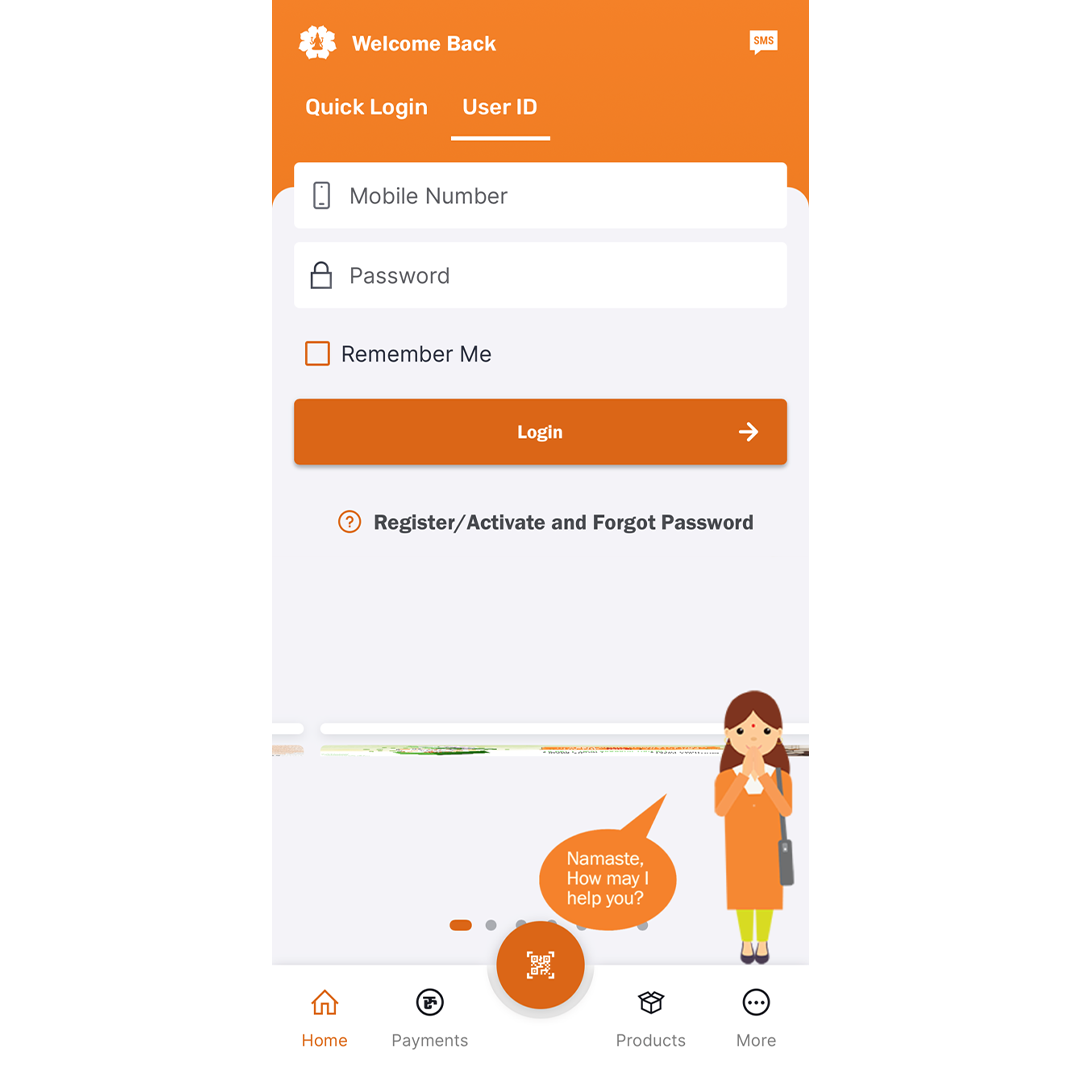

Enter your Mobile Number and Password and click on “Login”.

2. Step 2

Click on “Payments” on the dashboard, or click on “Mobile Topup” on the dashboard.

3. Step 3

Enter the Mobile Number to recharge and Recharge Amount and click on “Proceed”.

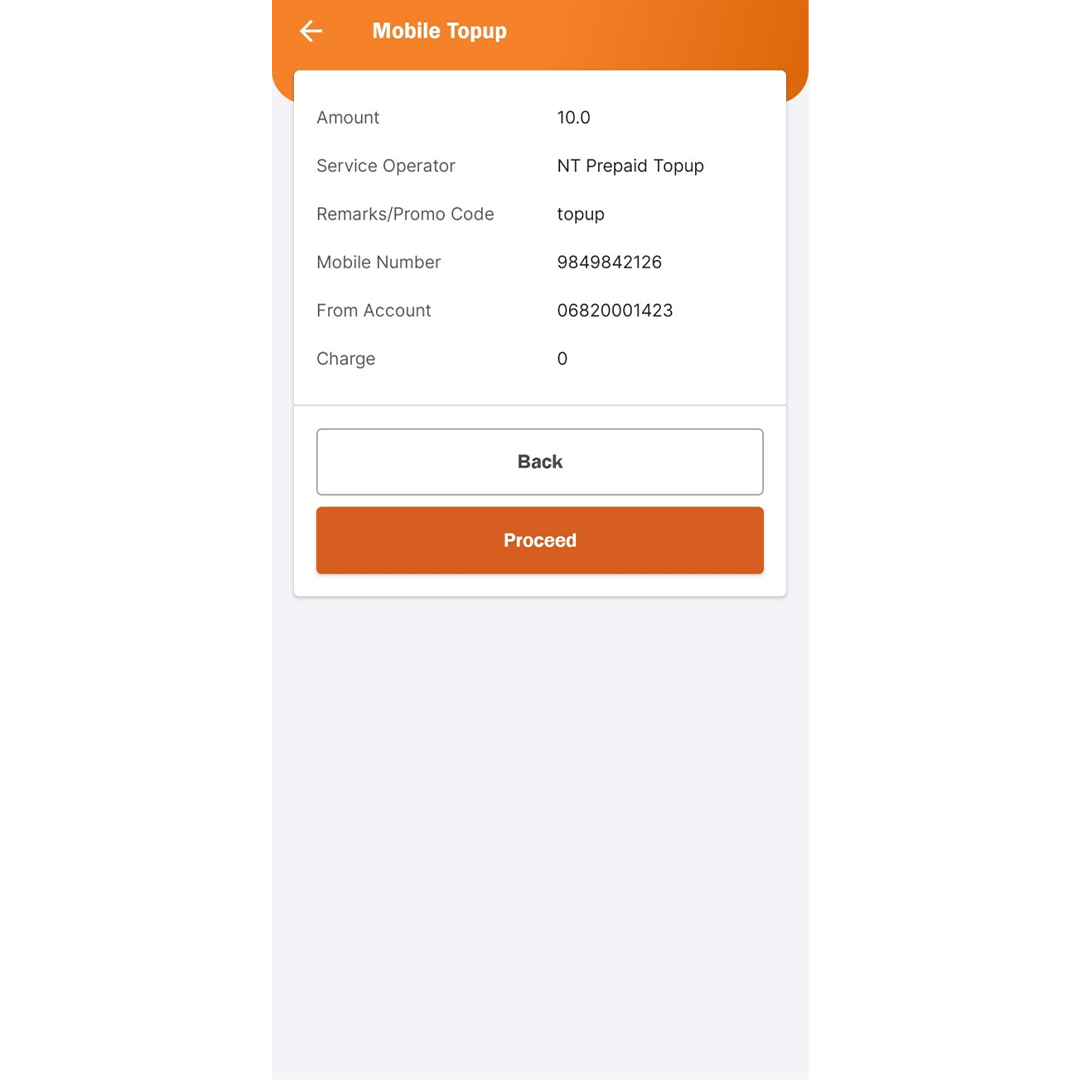

4. Step 4

Check the details and click on “Proceed”.

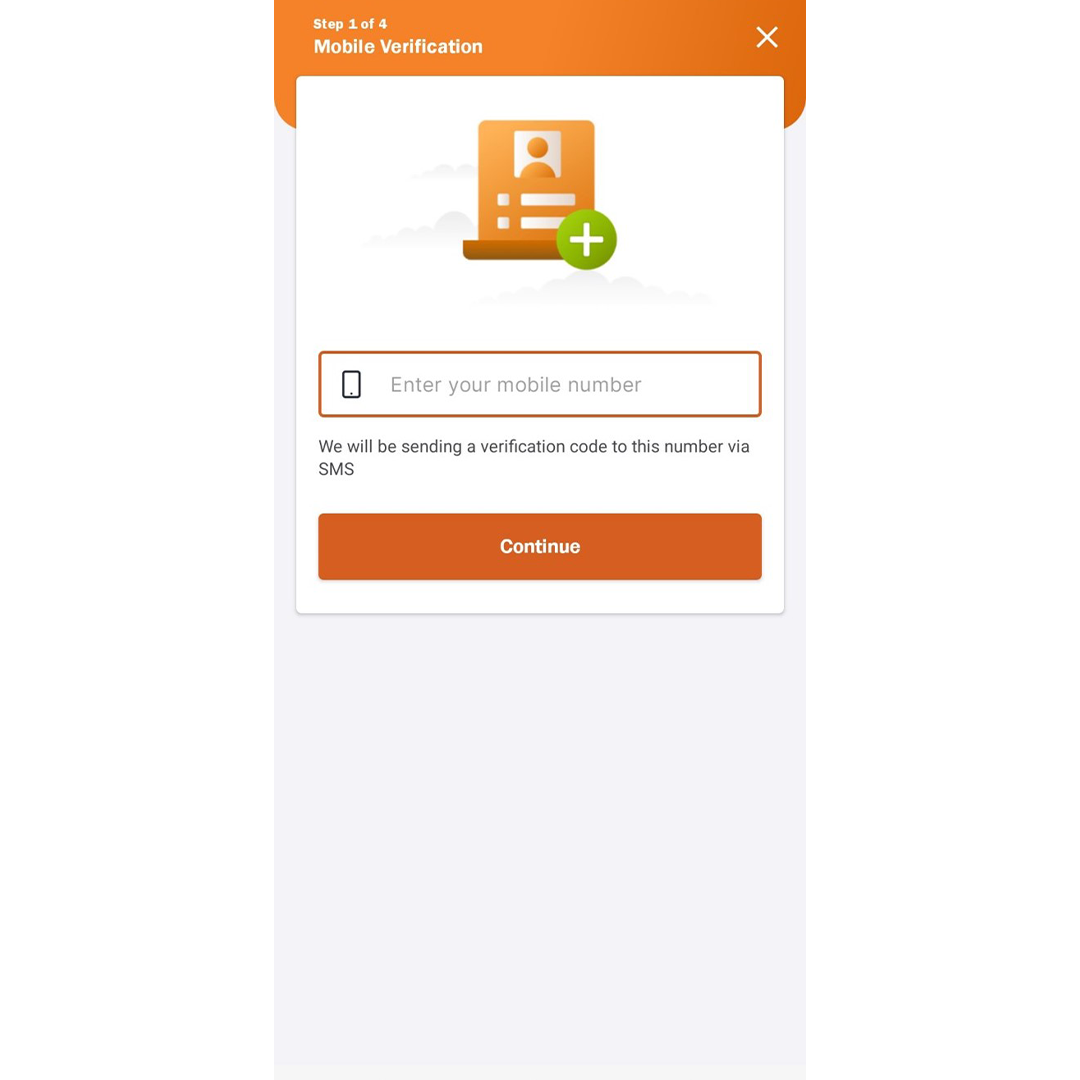

5. Step 5

Enter your 4-digit Transaction Pin and confirm the transaction. You can also use your Fingerprint or Face ID to confirm the transaction.

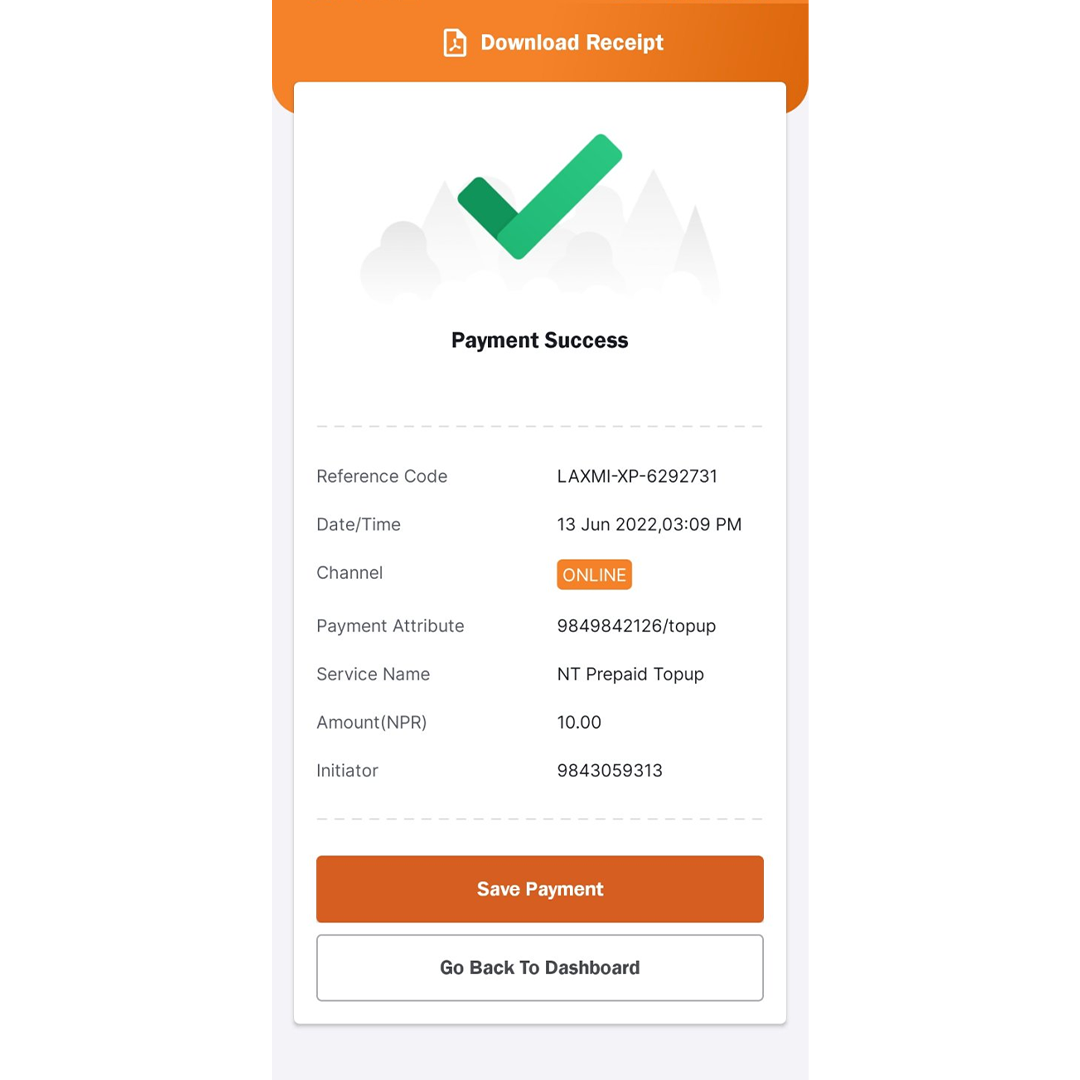

6. Step 6

You will be notified about the success on the screen.

How to register for Foneloan?

You need to register for Foneloan before you are able to avail loans. Here’s how you register for Foneloan.

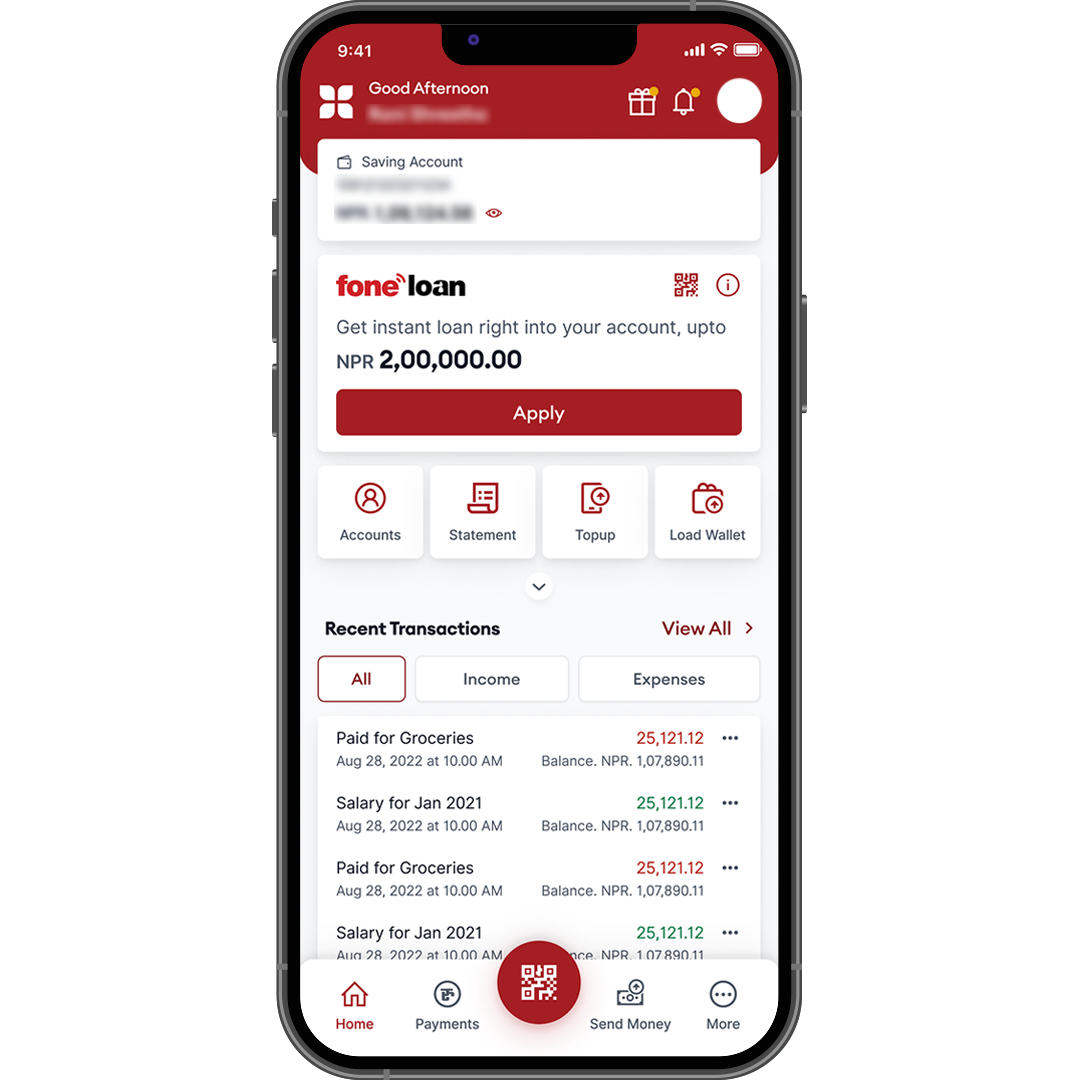

1. Apply

Check your dashboard for the “Foneloan” icon and click on the “Apply” button.

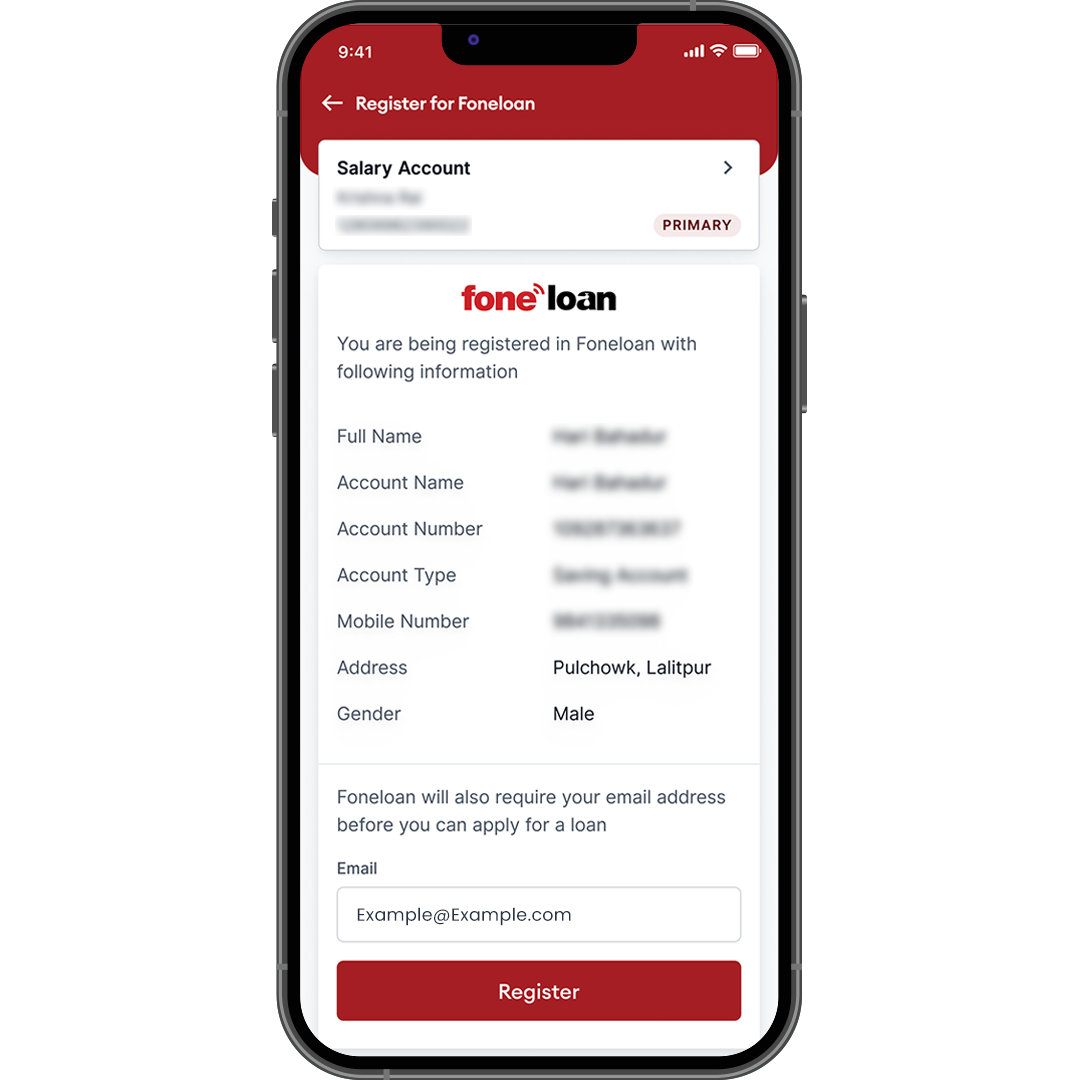

2. Register

Check your details and enter your email address, then click on “Register”.

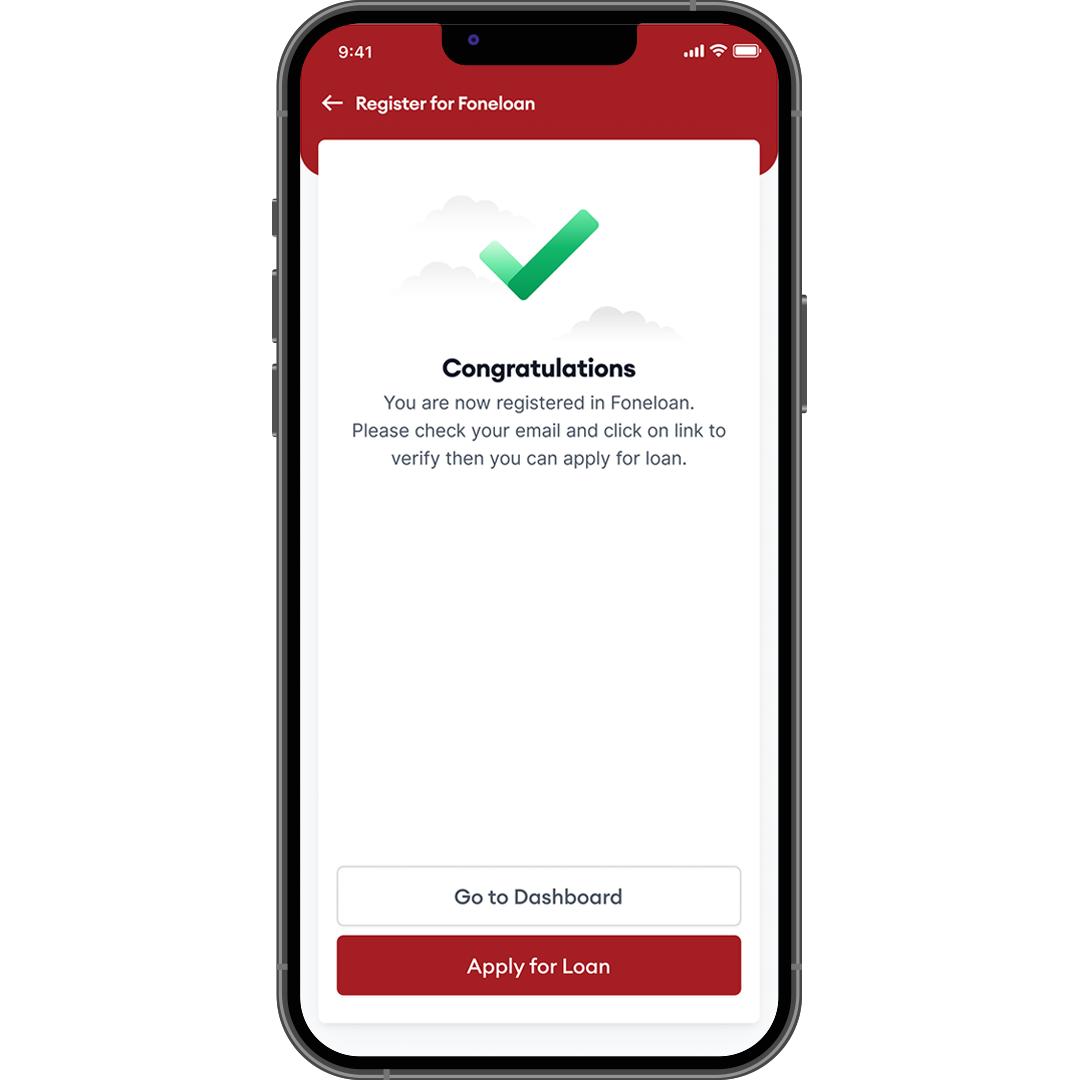

3. Registration Successful

Congratulations! You are now registered for Foneloan. Apply for loans up to your loan limit instantly.

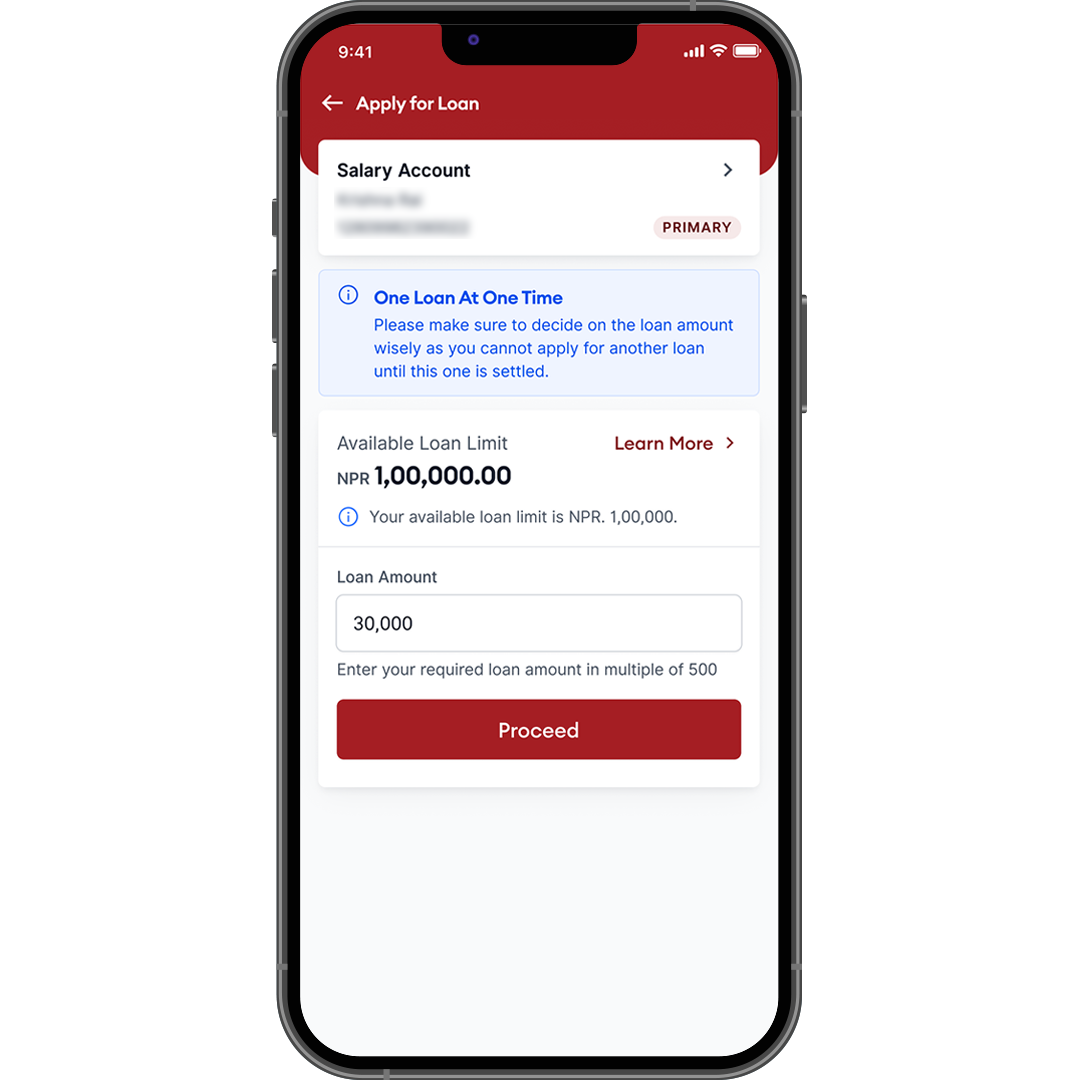

How to Apply for Loan using Foneloan?

Once you register for Foneloan, you can avail loans up to your set loan limit. Here is how you apply for loans.

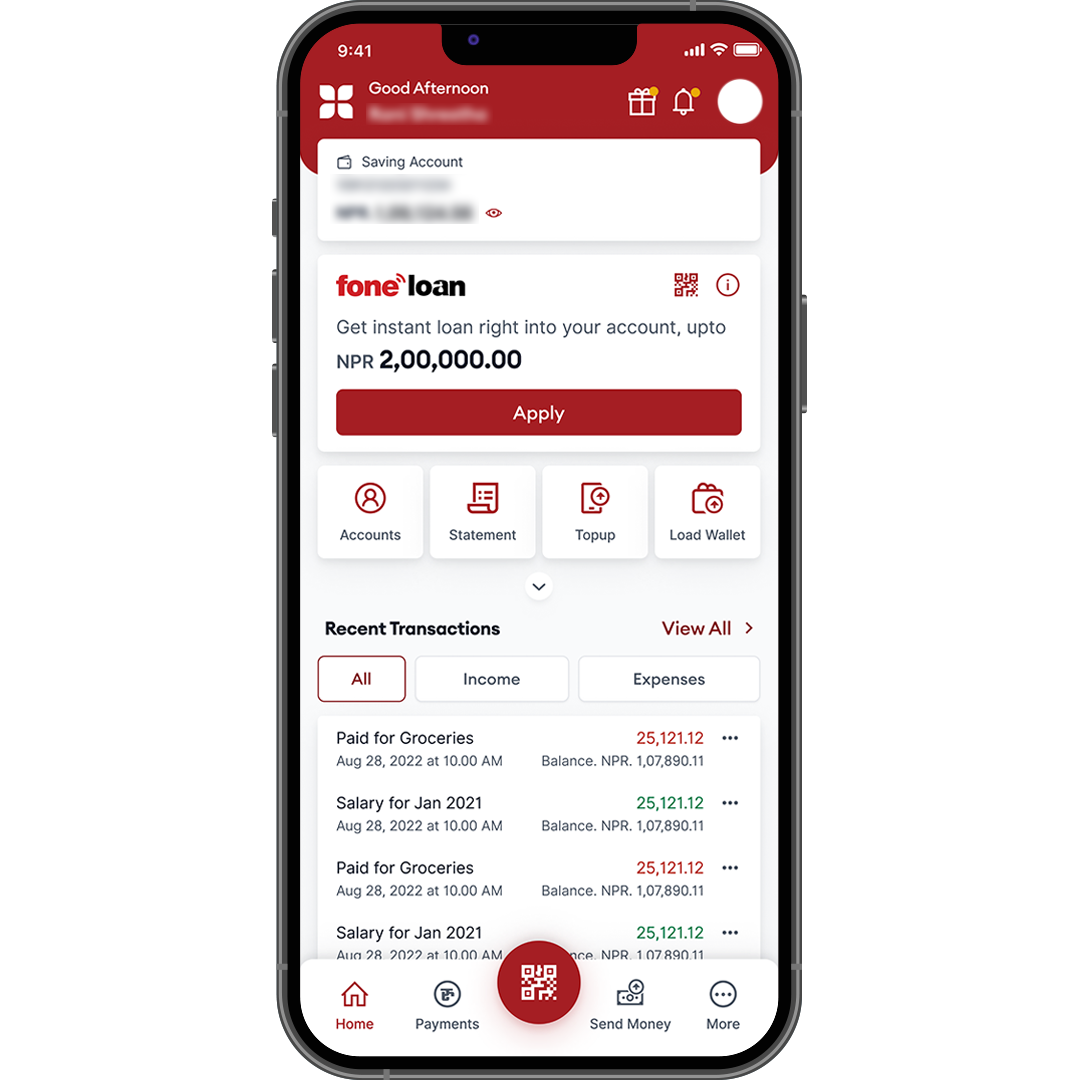

1. Apply

Check your dashboard for the “Foneloan” icon and click on the “Apply” button.

2. Loan Amount

Enter the loan amount you want, up to your loan limit.

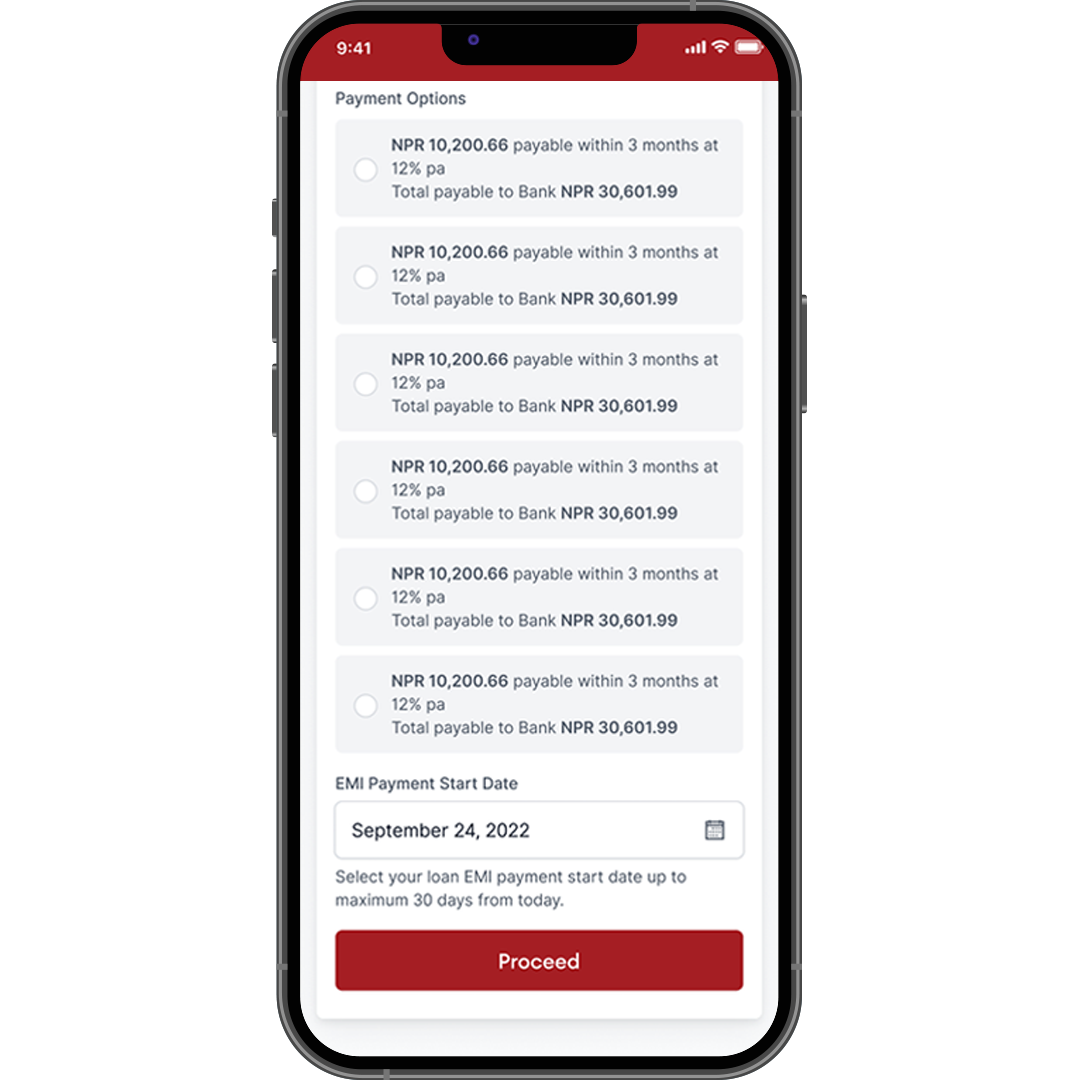

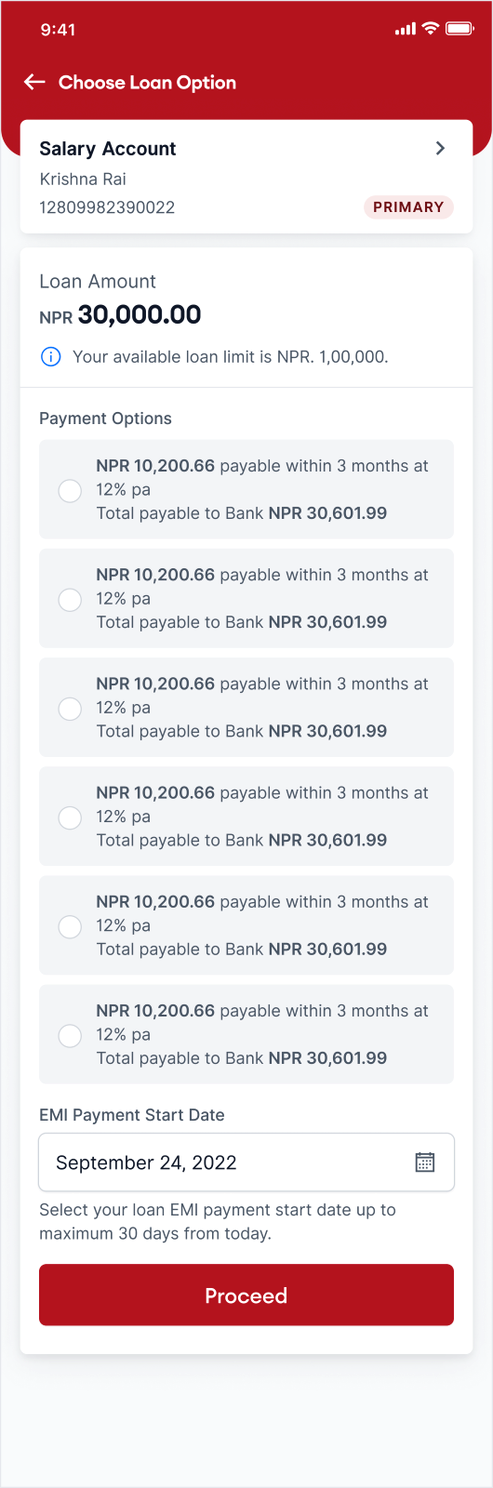

3. Choose Plan

Choose your payback plan and EMI payment start date.

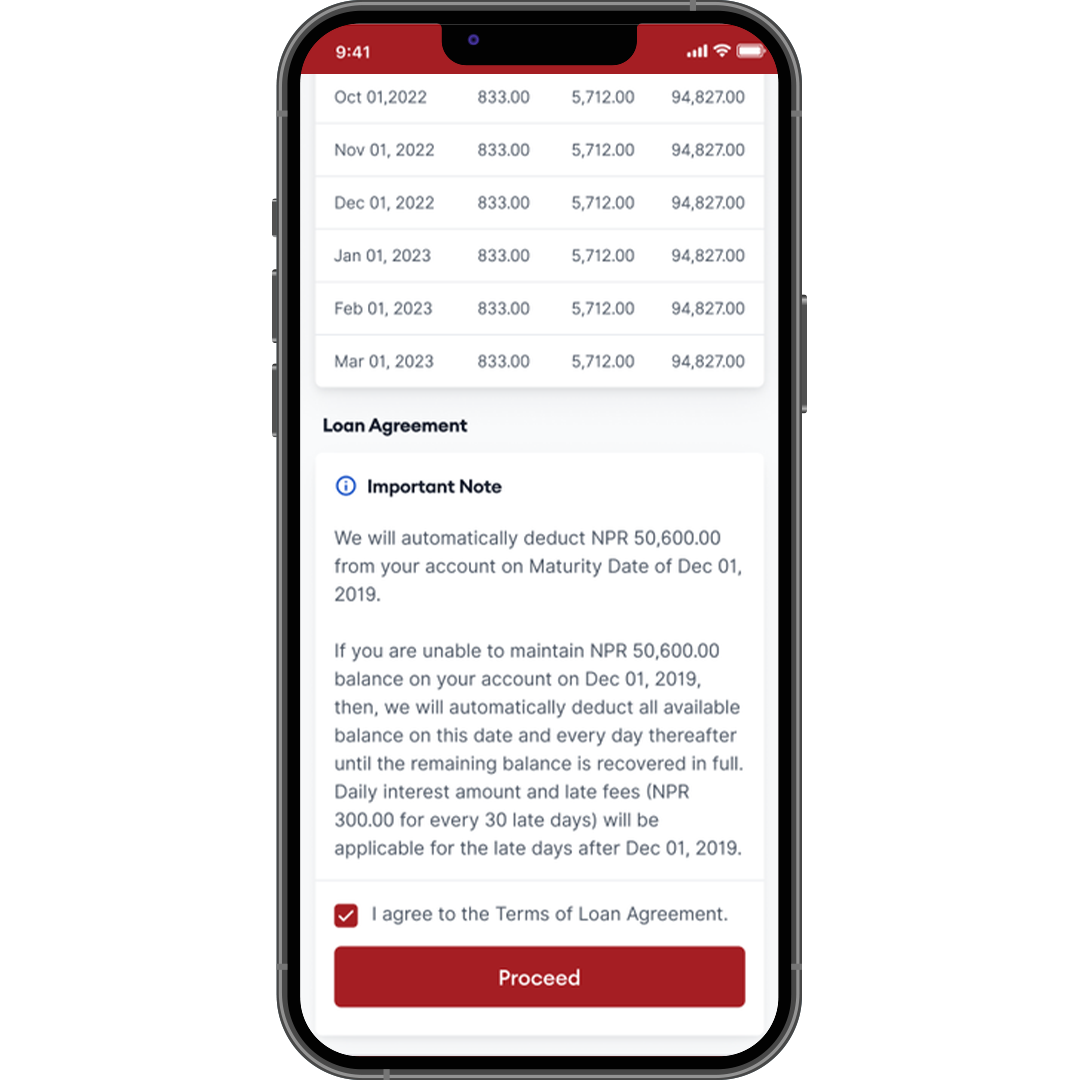

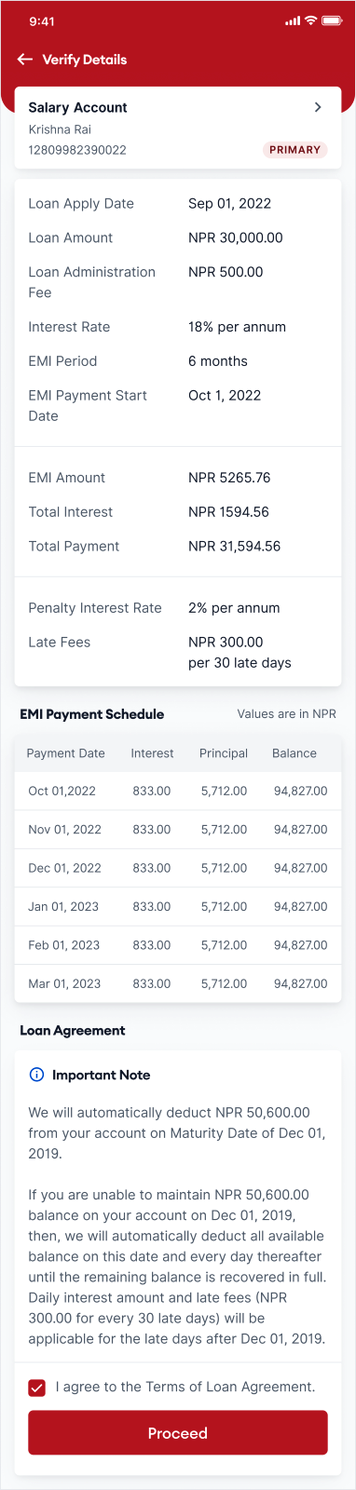

4. Details and Terms

Check the loan details and the terms of service and click on “Proceed”.

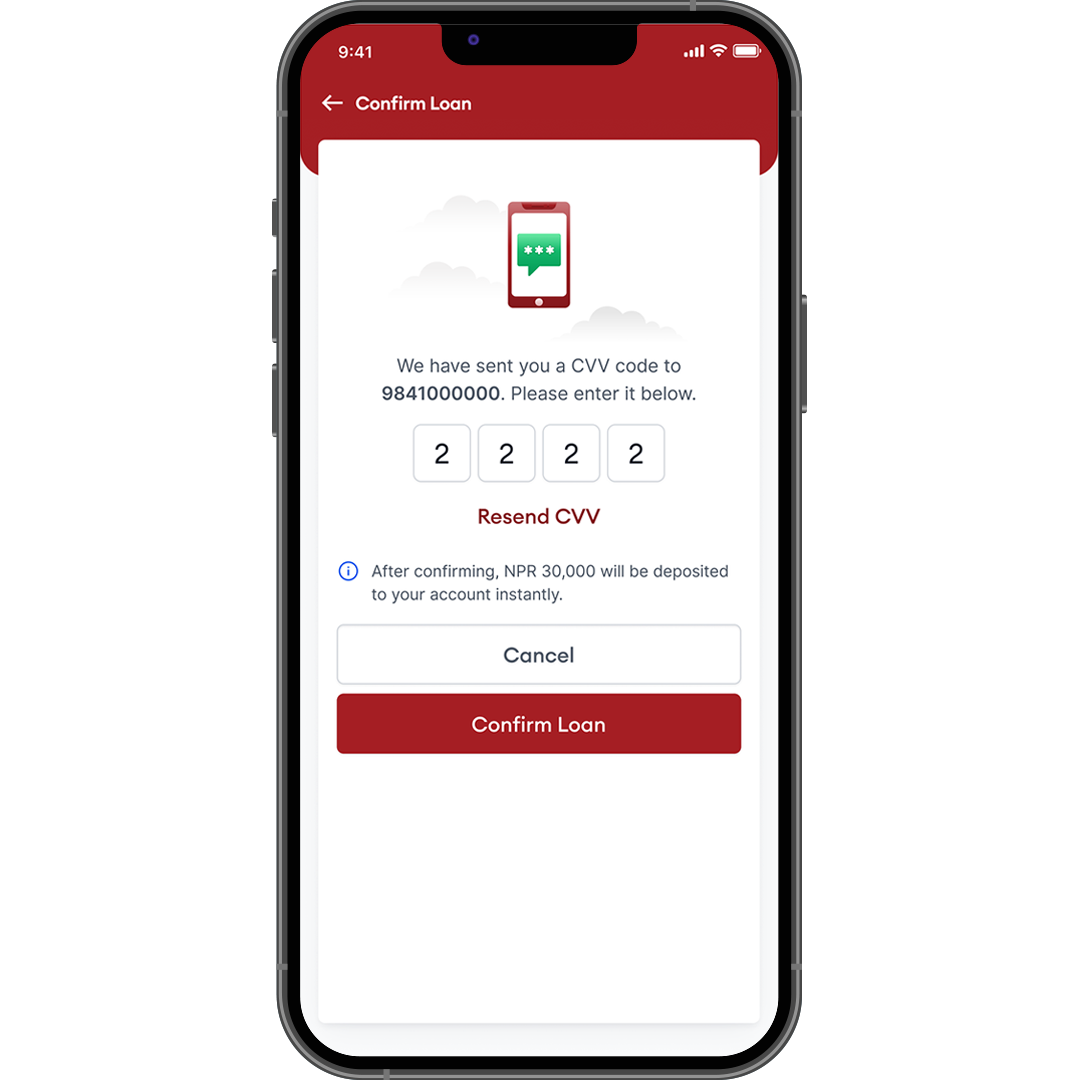

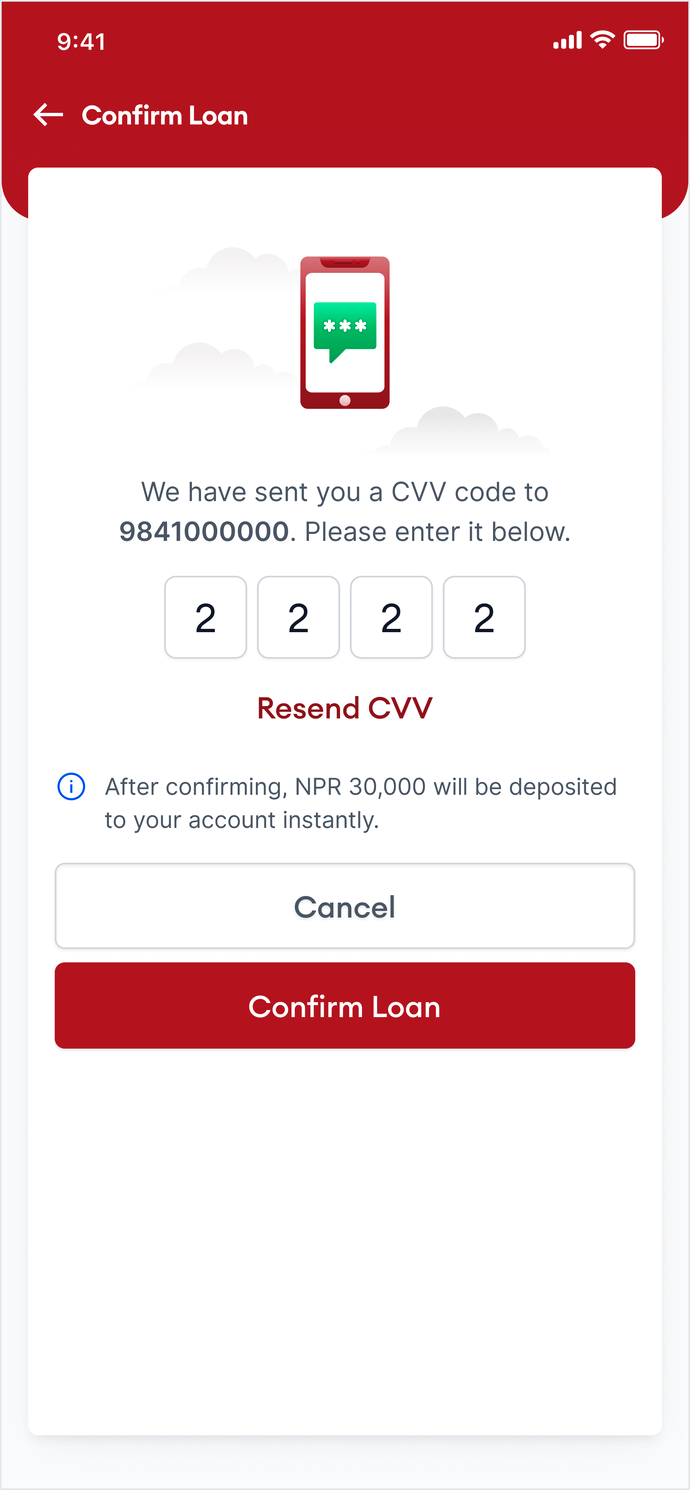

5. CVV Code

Enter the CVV code sent to your SMS inbox.

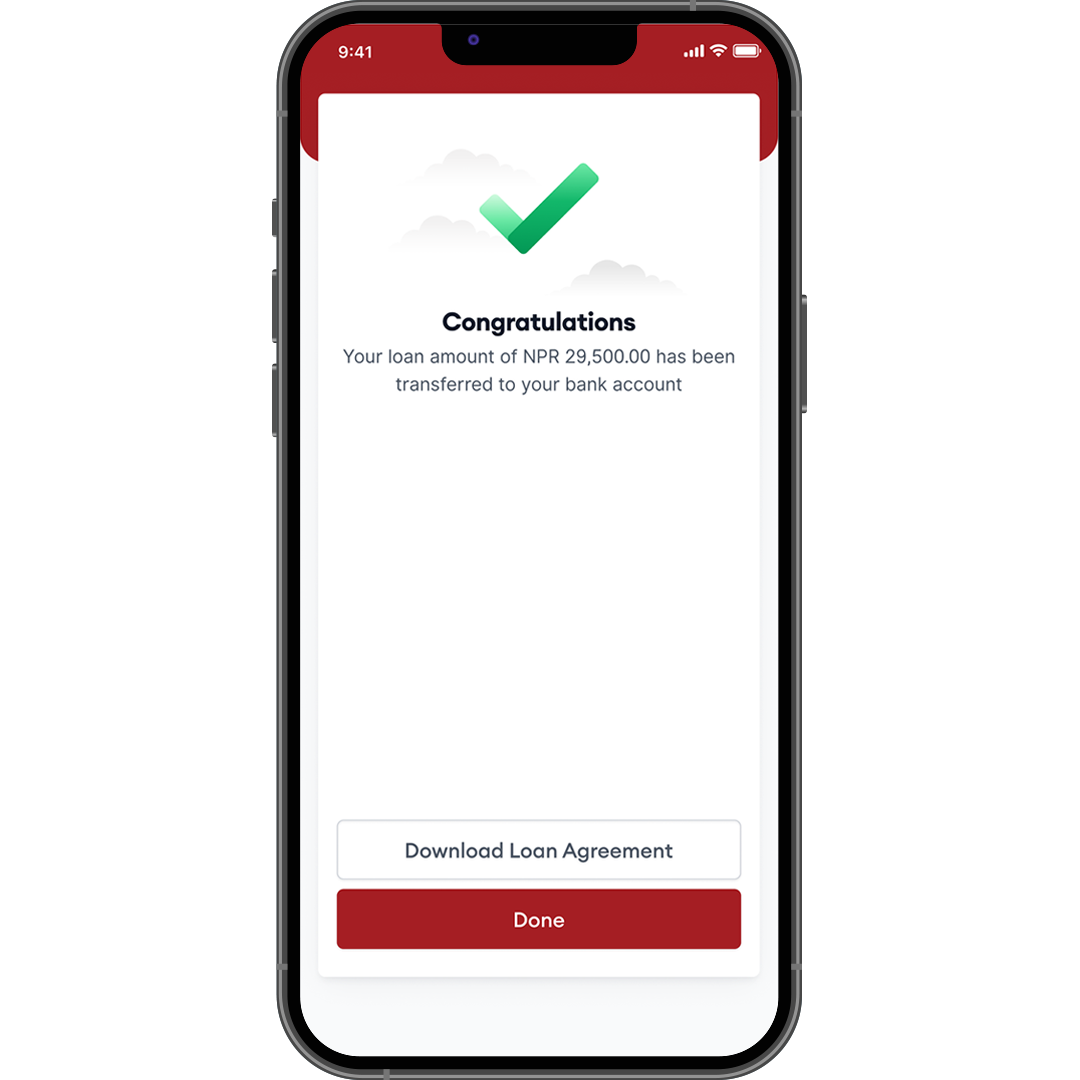

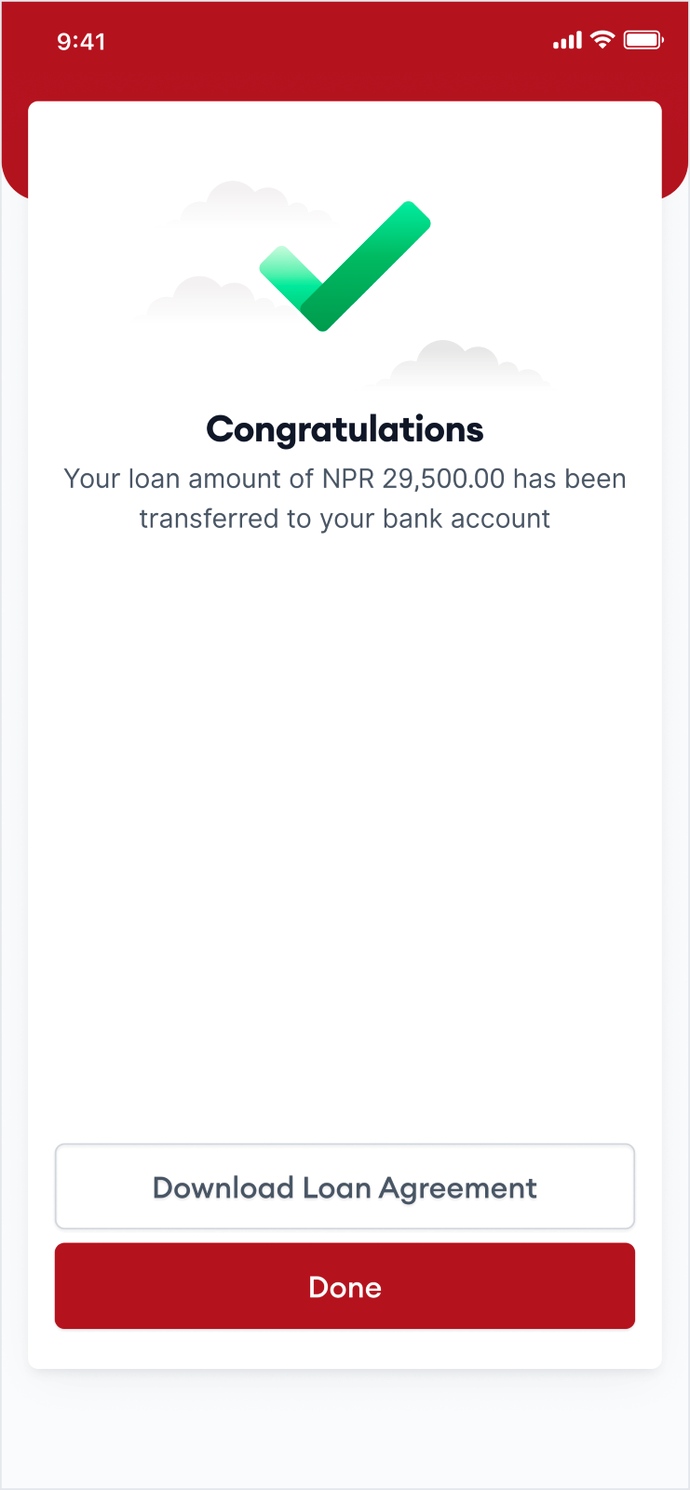

6. Foneloan Credited

The loan amount has been credited to your account. Enjoy your Foneloan!

How to use Foneloan - Buy Now Pay Later?

You can defer your purchases with any Fonepay QR merchants with Foneloan Buy Now Pay Later. Here is how you make purchases using Foneloan BNPL.

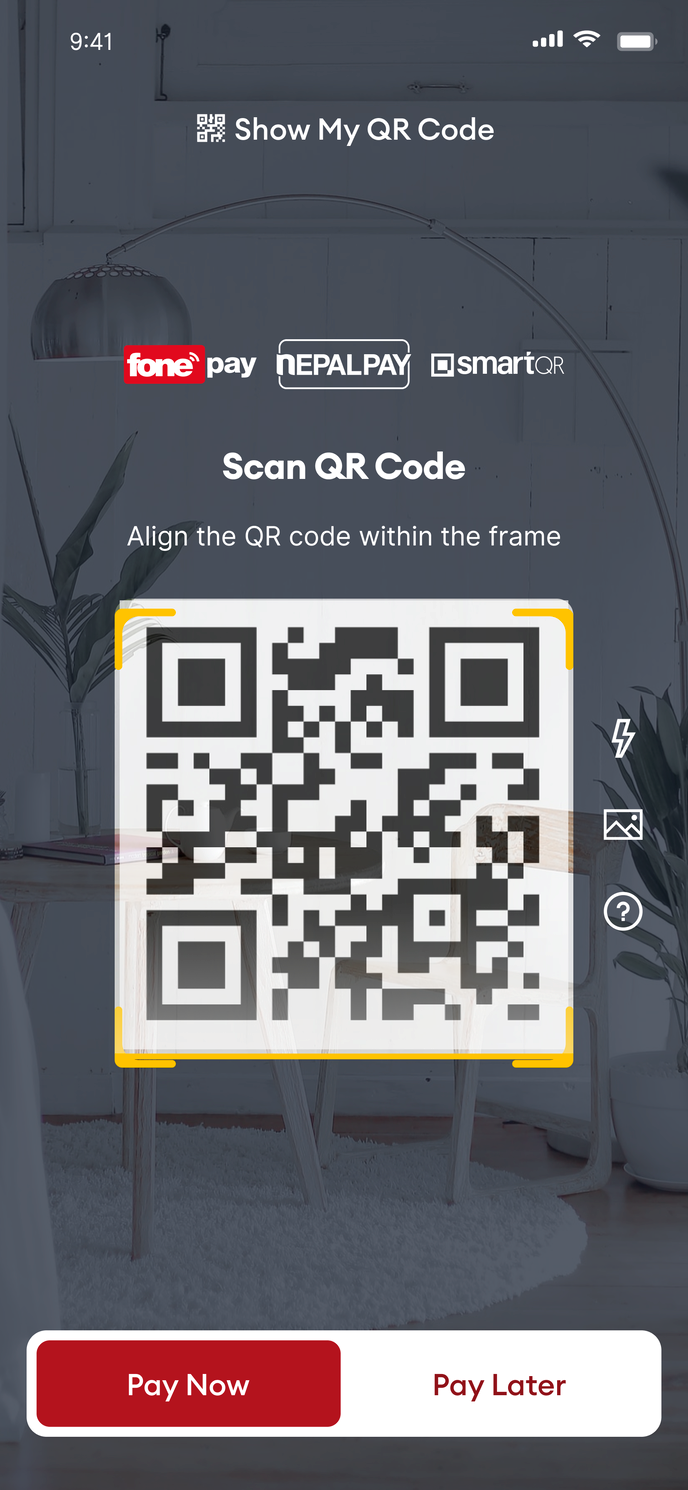

1. QR scan

Open the QR scan module on your mobile banking application.

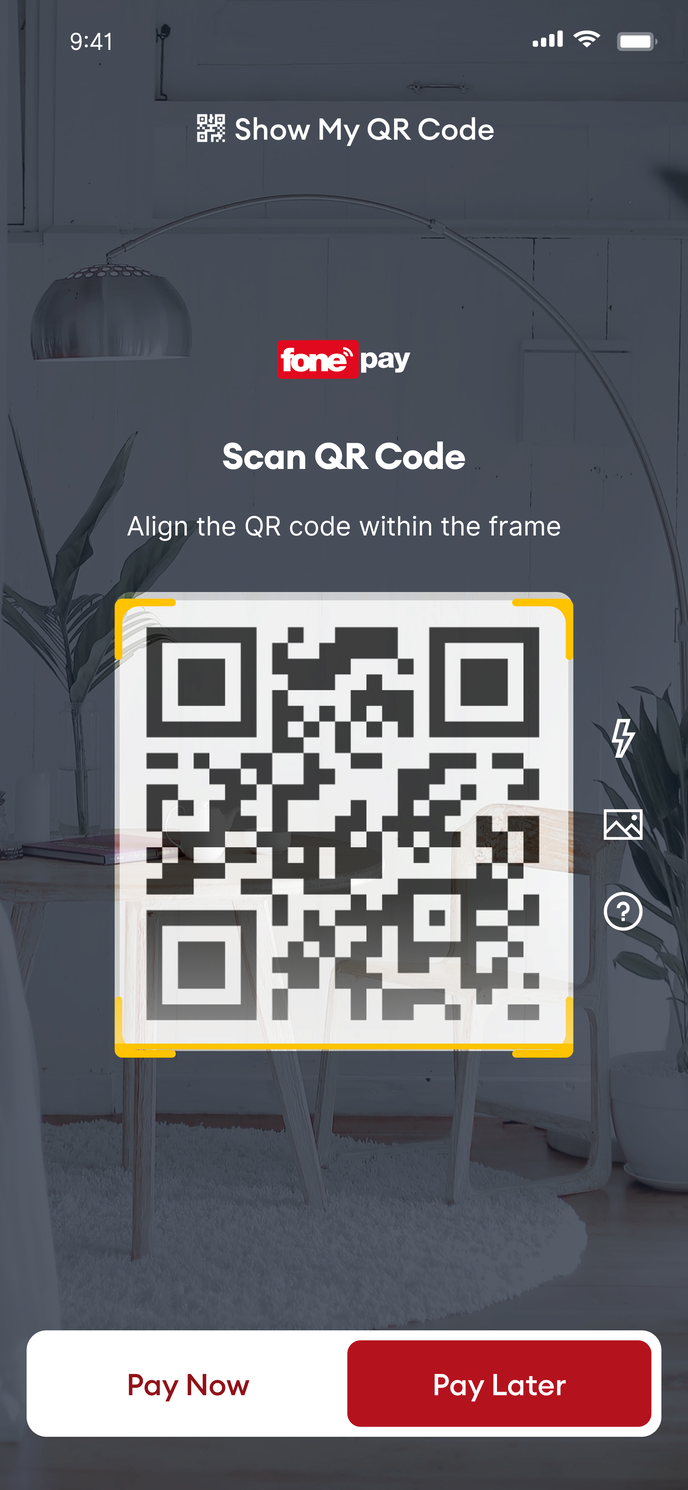

2. Pay Later

Select “Pay Later” from the options at the bottom of the screen.

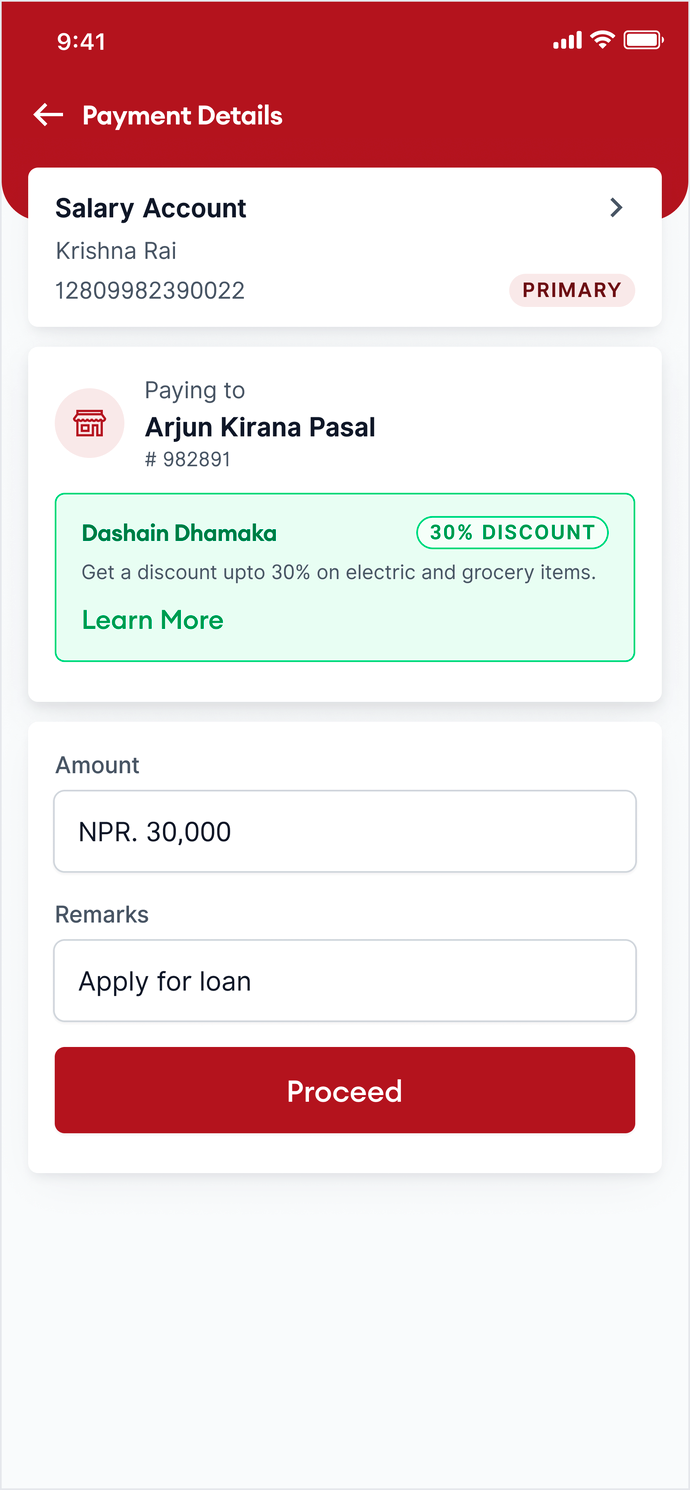

3. Payment Amount

Enter the payment amount and click on “Proceed”.

4. Select Plan

Choose your payback plan and EMI payment start date

5. Details and Terms

Check the loan details and the terms of service and click on “Proceed”.

6. CVV Code

Enter the CVV code sent to your SMS inbox.

7. Amount Credited

The amount has been credited to the merchant. Enjoy your purchase!

How to Prepay your Foneloan?

You can prepay your Foneloan before the settlement date if you have enough funds in your account. Here is how you prepay your Foneloan.

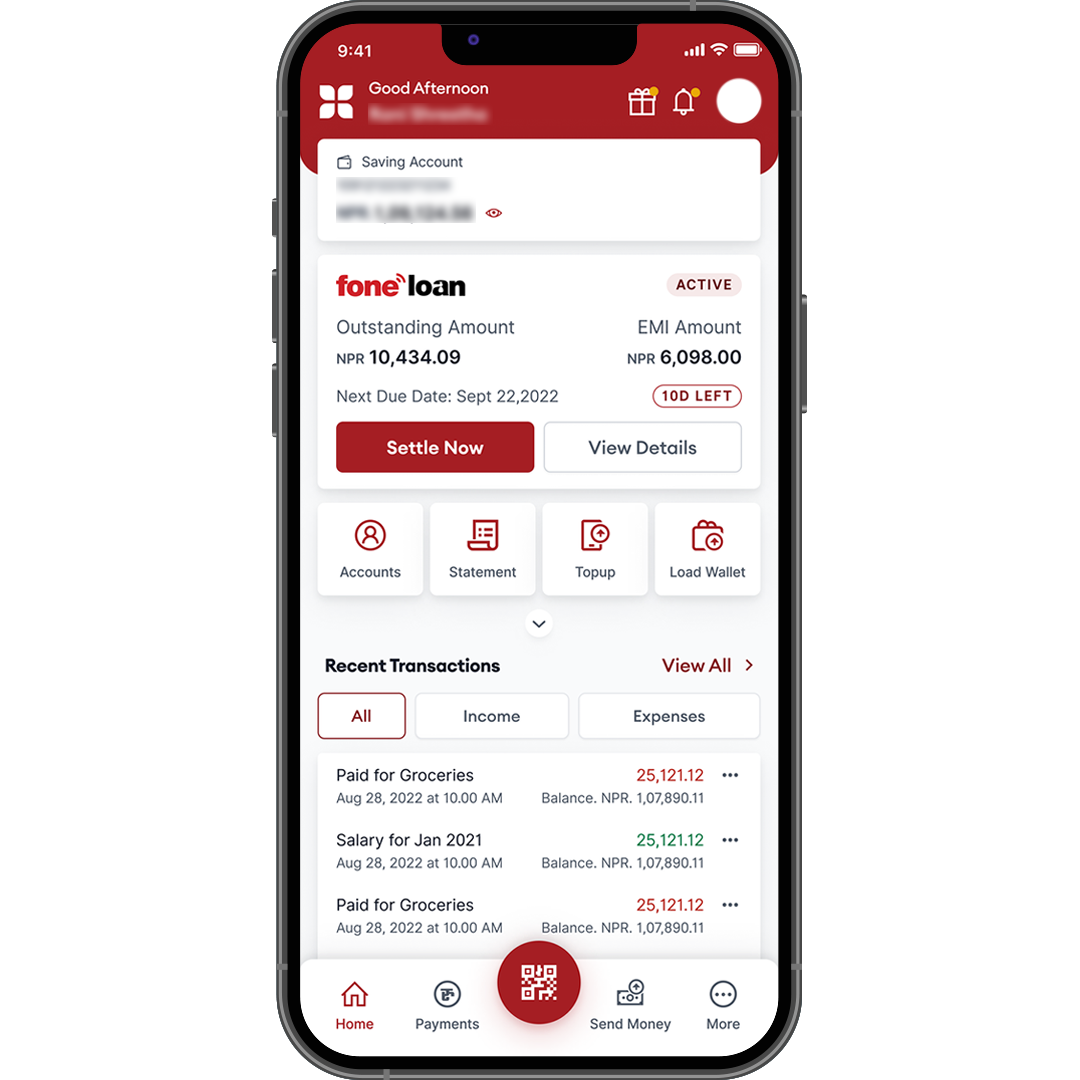

1. Settle Now

On the active loan dashboard, click on the “Settle Now” button.

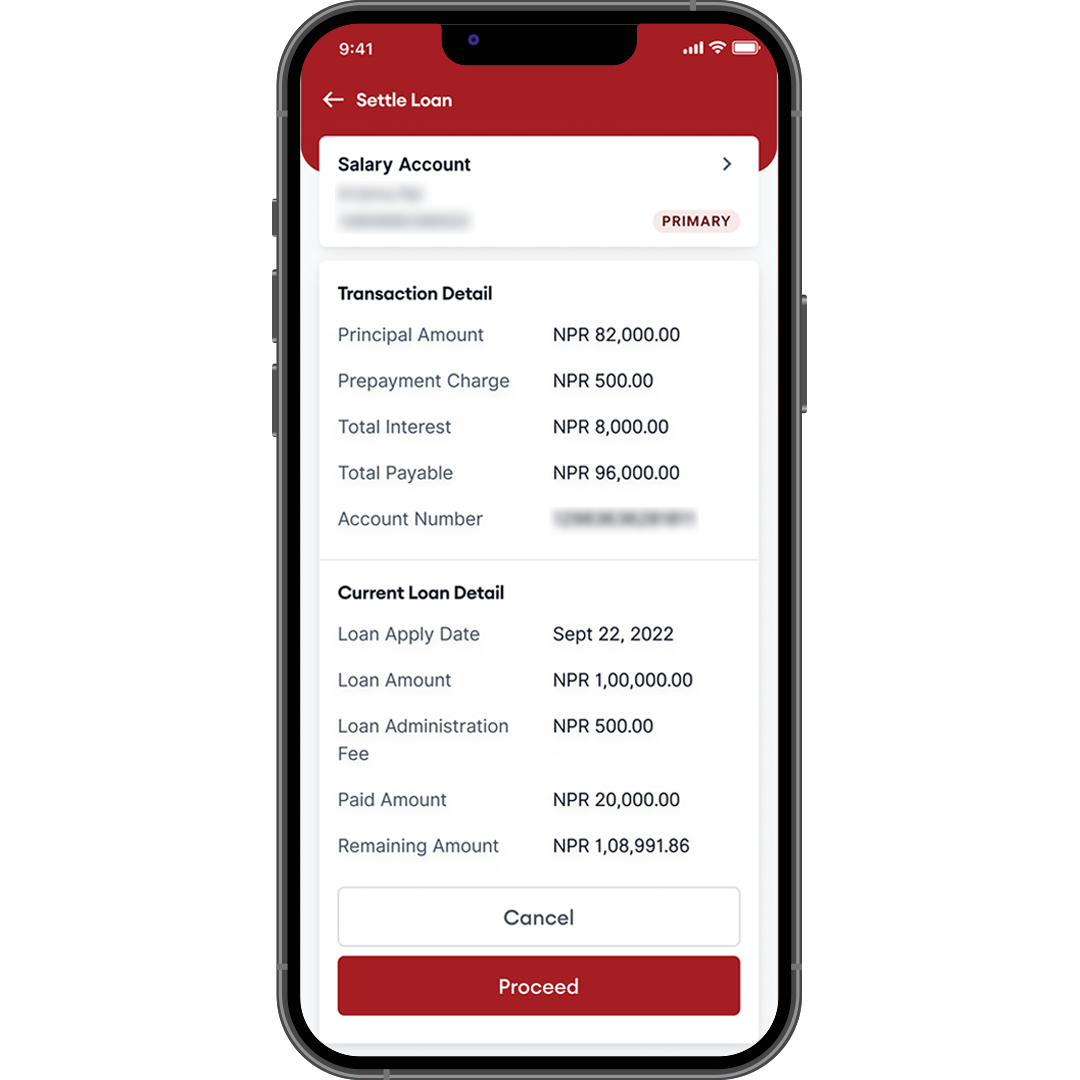

2. Payment Details

Check your payment details and click on “Proceed”.

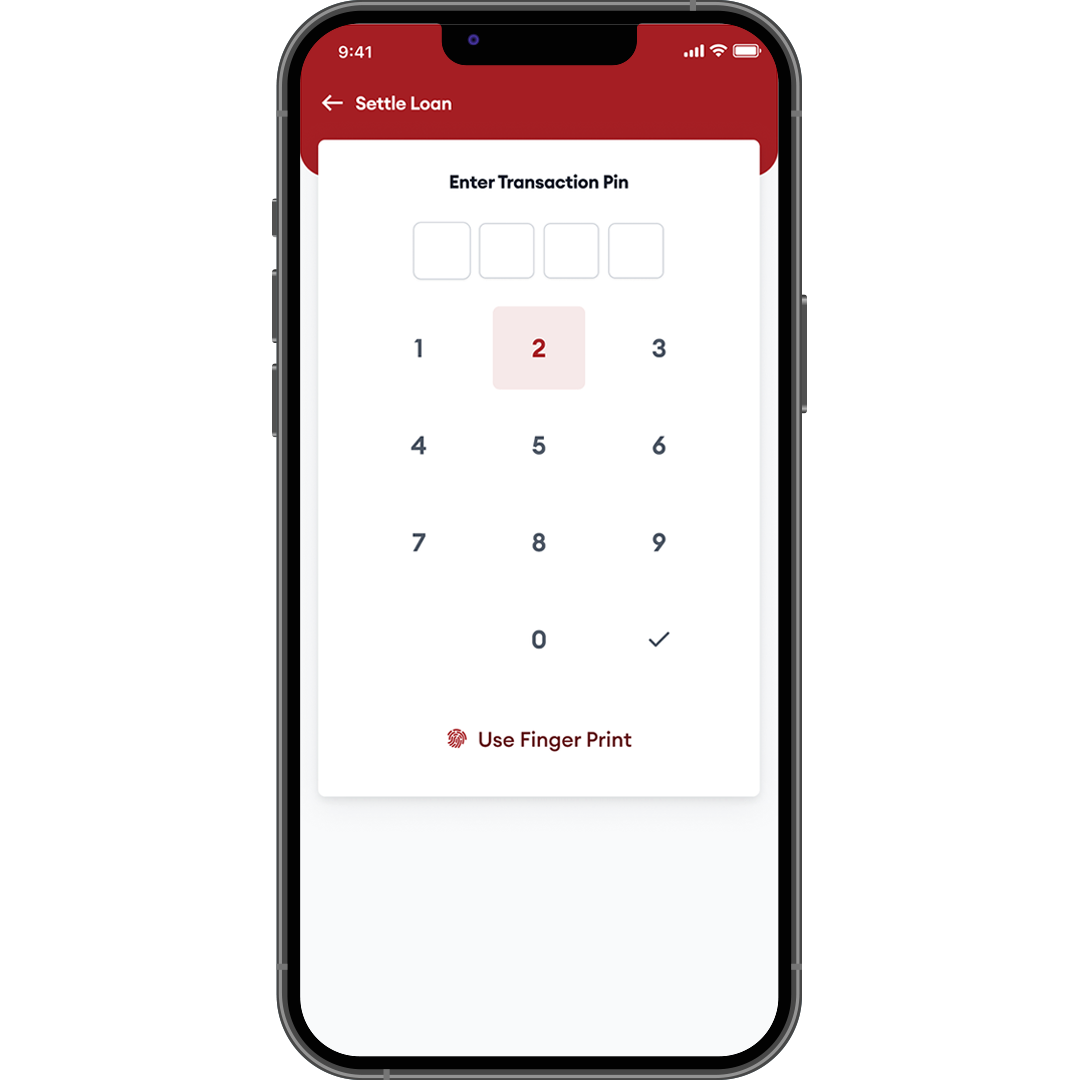

3. Transaction PIN

Enter your transaction PIN to confirm the transaction.

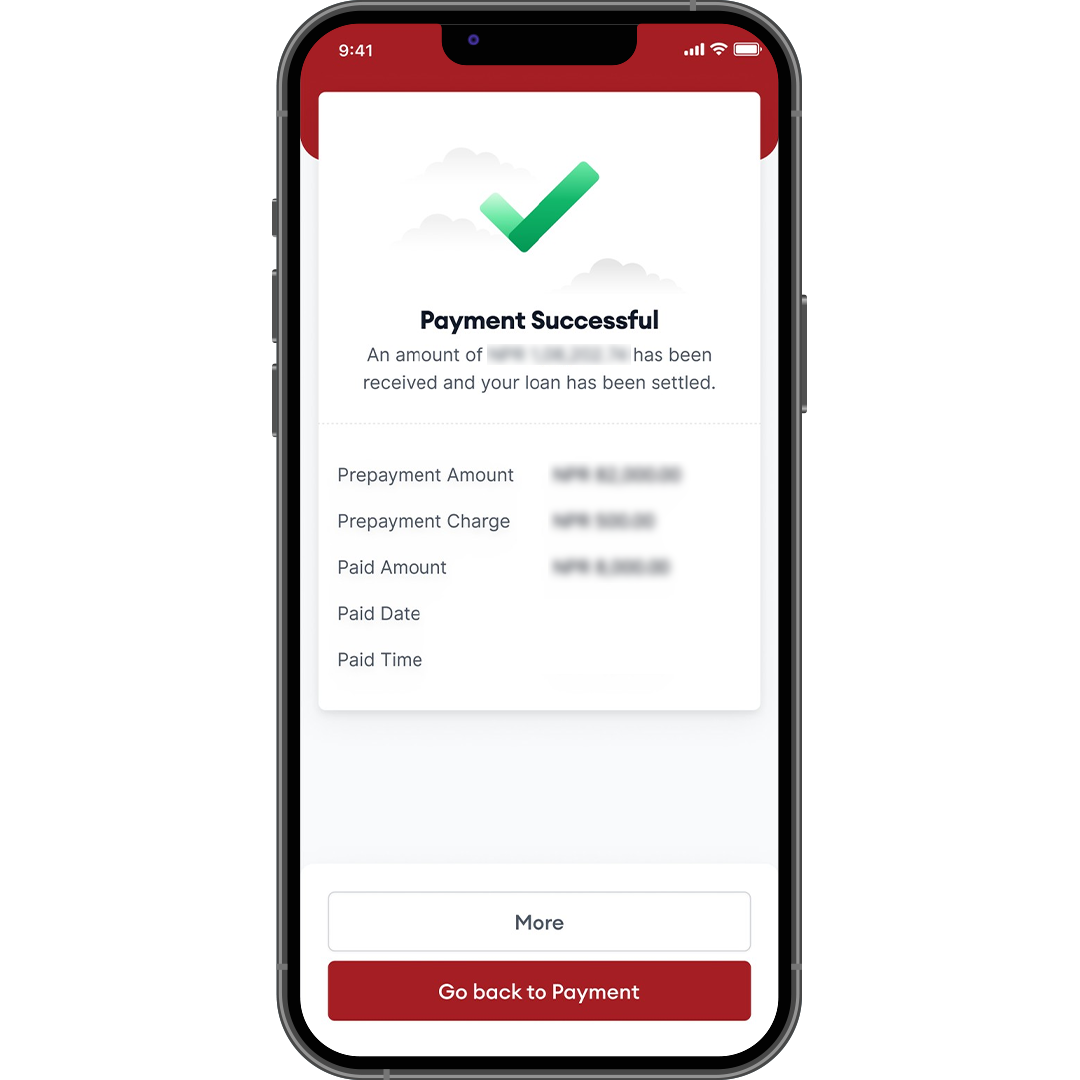

4. Loan Settled

Your loan is now settled. You can avail Foneloan again!

Laxmi Mobile Money Features

Mobile Money is a convenient, real-time and safe banking channel that allows you to access your Laxmi Bank account using your mobile phone through Data (e.g. 3G), WiFi or SMS.

Mobile Money uses 2 Factor Authentication (2FA). 2FA is based on the principle of:

- What you know: i.e. your Password, and

- What you have: i.e. your mobile phone

Your mobile phone is recognized and registered by our system when you first sign in with your username and password. After this, your account cannot be accessed from any other mobile phones even if the correct username and password is used.